The perspective on the asset known as Bitcoin varies greatly. Some people view it as an innovative store of value and a means of payment, while others see it as nothing more than a worthless piece of data.

Similarly, the methodology for evaluating the intrinsic value of Bitcoin is currently not clearly established, which can be seen as a difference from the traditional financial market where various valuation methodologies have taken root. However, there have been various attempts to evaluate value in the cryptocurrency market, such as in the case of Bitcoin. For Bitcoin, it is possible to indirectly derive relative value by examining factors such as the historical price movements of the asset, as well as the actions of current and past holders.

In traditional financial markets like the stock market, it is difficult to trace and analyze all transaction records. However, blockchain-based cryptocurrencies like Bitcoin record all transactions, such as asset holdings and transfers, on the blockchain, and these transaction data recorded on the blockchain are referred to as "on-chain data." On-chain data is transparently available for anyone to view, so by analyzing and processing the publicly available on-chain data, it is possible to evaluate the value of cryptocurrencies like Bitcoin or utilize it for price trend predictions.

So, what is the current situation of on-chain data indicators for Bitcoin, and how can we interpret the price movements of Bitcoin? Today, we will analyze the market's current position through two representative on-chain data indicators for Bitcoin: the "MVRV ratio" and the "movement based on wallet holdings."

MVRV Ratio (Market Value / Realized Value)

MVRV is one of the most commonly used indicators among Bitcoin on-chain data.

MV represents the current Market Value of Bitcoin, while RV represents the Realized Value of Bitcoin. The MVRV ratio is calculated by dividing the Market Value of Bitcoin by its Realized Value.

Among the components of the MVRV ratio indicator, Market Value is a familiar concept and can be calculated as the current price of Bitcoin multiplied by its circulating supply. However, to interpret the meaning of the MVRV ratio, one needs to understand the somewhat unfamiliar concept of "Realized Value." The Realized Value is calculated as the price at which the Bitcoin last moved (transferred) multiplied by its circulating supply, and it can be considered as the Market Value calculated based on the price at which Bitcoin holders acquired it (through purchase, mining, etc.).

Let's try to understand the concept of Realized MVRV ratio using the following assumptions:

- Assume there are three participants, A, B, and C, in the entire Bitcoin market.

- On January 1, 2023, participants A, B, and C each received 10 BTC through mining, and the price of Bitcoin at that time was $10,000.

In this case, the Market Value (MV) on January 1, 2023, is 30 BTC * $10,000 = $300,000. Similarly, the Realized Value is also $300,000, calculated as 30 BTC * $10,000. Since January 1 is the point at which Bitcoin last moved due to mining rewards, the Realized Value is calculated based on the price of that day.

Therefore, the MVRV ratio for January 2023 is $300,000 / $300,000 = 1.

Afterwards, let's assume that on June 1, 2023, the market experienced the following changes:

- The price of Bitcoin rose to $20,000.

- A transferred their 10 BTC to B, resulting in A holding 0 BTC, B holding 20 BTC, and C holding 10 BTC.

What would be the MVRV ratio on June 1?

First, the Market Value (MV) on June 1 would be 30 BTC * $20,000 = $600,000. The Realized Value (RV) would be calculated as (20 BTC * $10,000) + (10 BTC * $20,000) = $400,000. Looking at the calculation process of the Realized Value, the quantities of 10 BTC each held by B and C that were not moved since the mining on January 1 would be multiplied by the price on January 1, the "last moved" point. The quantity of 10 BTC transferred from A to B would be multiplied by the price on June 1, the "last moved" point for that specific transaction.

Therefore, the MVRV ratio on June 1 would be $600,000 / $400,000 = 1.5.

In other words, on June 1, Bitcoin would be relatively overvalued compared to January 1. By comparing the Market Value (MV) and Realized Value (RV) using the MVRV ratio, we can assess whether Bitcoin is currently relatively overvalued or undervalued.

In reality, when looking at historical cases, Bitcoin has shown a tendency to form bottoming patterns with limited further declines during periods when the MVRV ratio is below 1. However, does that mean that any period when the MVRV ratio is above 1 should be interpreted as an overvaluation and a selling point?

As can be seen from the graph, it is not always the case. The average MVRV ratio for Bitcoin, following its halving cycle that occurs approximately every four years, has been around 1.7. There have been instances where this level has acted as a turning point for price increases.

Therefore, it is important to consider the context and other factors in addition to the MVRV ratio when interpreting Bitcoin's valuation. The MVRV ratio is just one indicator among many that can provide insights into the market, but it should be used in conjunction with other tools and analysis to make well-informed investment decisions.

Based on the MVRV ratio indicator, the current position of the market can be analyzed as follows:

- The current MVRV ratio is above 1, indicating that the current Market Value of Bitcoin is not undervalued relative to the Realized Value (price comparison).

- However, the current MVRV ratio is positioned lower than the four-year cycle average, suggesting a relatively undervalued state compared to the past (time comparison).

Therefore, while the current MVRV ratio does not indicate significant undervaluation based on price comparison, it suggests a potential undervalued state when considering the historical context and the average MVRV ratio observed during the four-year cycle of Bitcoin. It's important to note that market conditions are complex, and multiple factors should be taken into account when making investment decisions.

Analysis of Behavior Based on Wallet Holdings

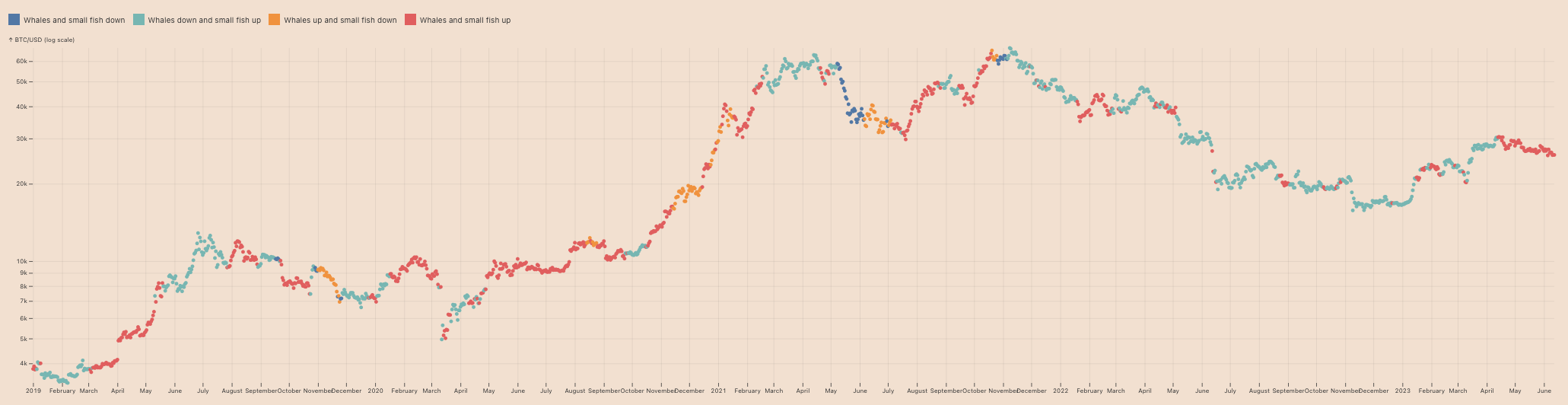

In the Bitcoin market, entities with a significant amount of holdings, often referred to as "whales," can have a direct impact on prices. While the trading activities of small-scale holders can also have an influence on the market, it is generally the movements of entities with large holdings that carry more weight. Therefore, observing the actions of these "whales" who hold substantial amounts of Bitcoin can provide indirect insights into the market sentiment and potential trends.

Monitoring the behavior of whales can involve analyzing their buying and selling patterns, movement of funds, and other actions that indicate their market participation. For example, if whales are consistently accumulating Bitcoin by increasing their holdings, it may indicate a bullish sentiment and potentially foreshadow a positive market outlook. On the other hand, if whales are actively selling off their holdings, it may suggest a bearish sentiment and signal a potential downturn in the market.

It's important to note that analyzing whale behavior should be done in conjunction with other market indicators and factors, as market dynamics are complex and influenced by various elements. Nonetheless, studying the actions of whales can provide valuable insights for indirectly assessing market sentiment and making informed investment decisions.

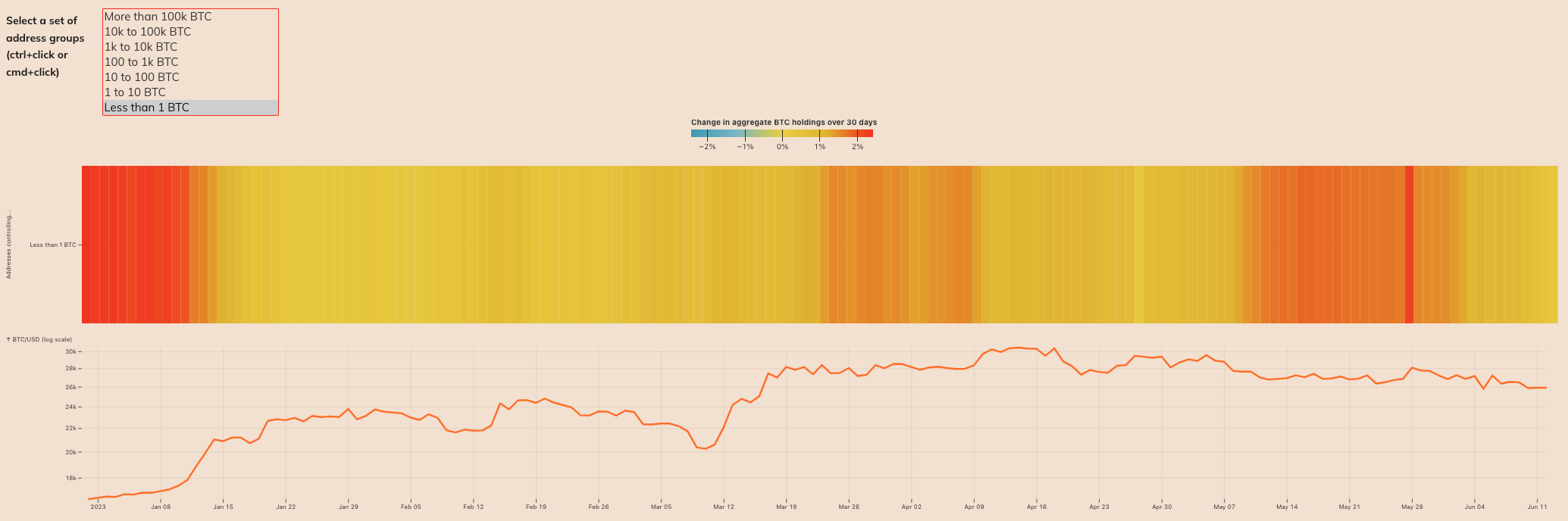

The chart above shows the changes in Bitcoin holdings among wallets that hold 1 BTC or less. The redder the color, the more these wallets increased their holdings during that period, while the bluer the color, the more they decreased their holdings. As can be seen, the lack of prominent blue color indicates that small-scale holders have been consistently increasing their holdings. Therefore, it may be challenging to interpret the market sentiment solely based on the movements of small-scale users.

Indeed, due to the large number of small-scale holders and their individual actions, it can be difficult to derive meaningful insights about the overall market sentiment solely from their behavior. It is essential to consider the actions of other market participants, including whales and institutional investors, as they often have a more significant impact on market trends and price movements.

While analyzing the behavior of small-scale holders can provide some insights, it should be done in conjunction with other market indicators and factors for a more comprehensive understanding of the market dynamics and sentiment.

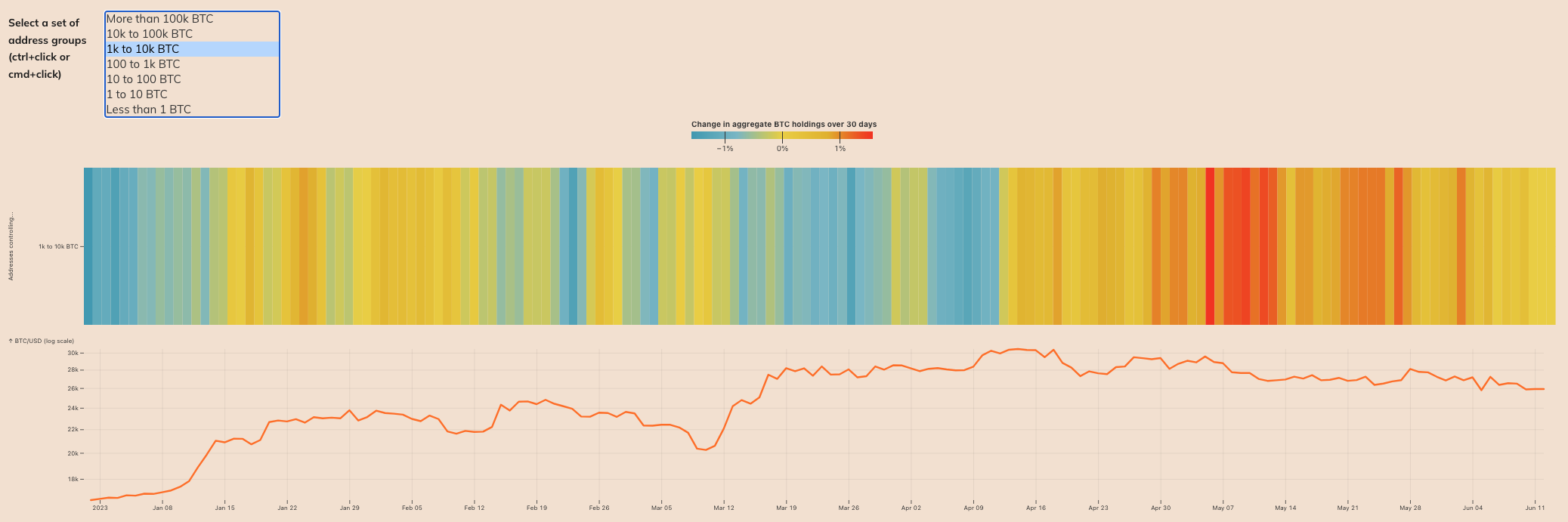

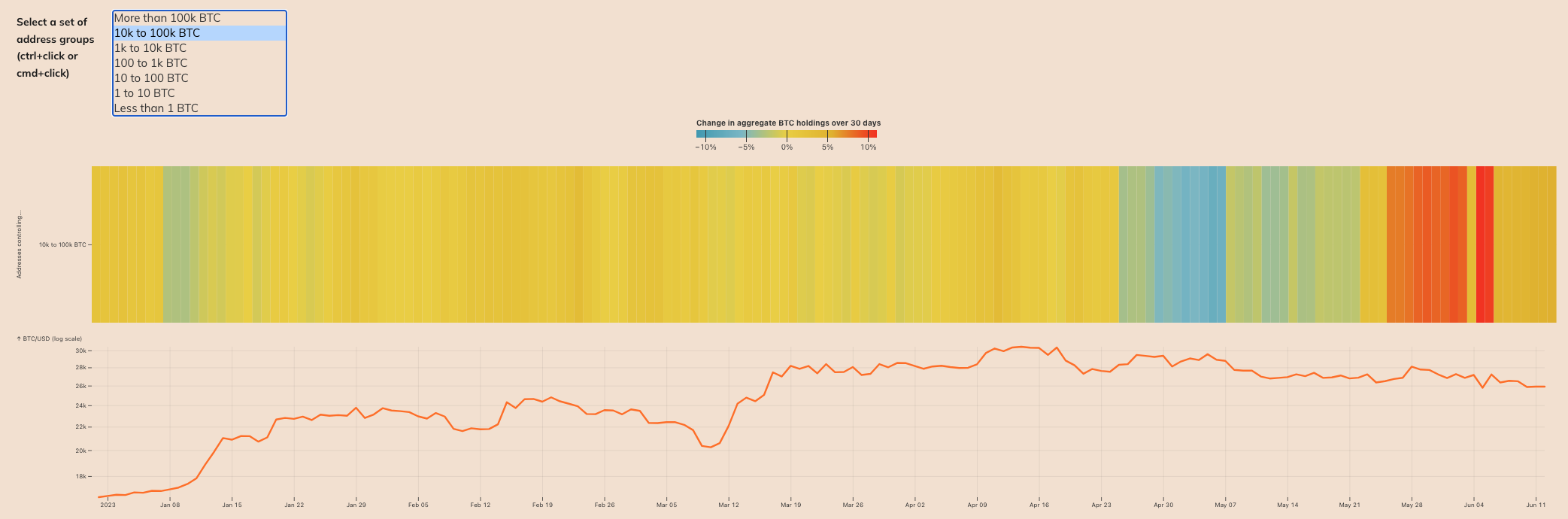

However, it can be observed that "whales" holding between 1,000 BTC and 10,000 BTC (upper range) or between 10,000 BTC and 100,000 BTC (lower range) react sensitively to market conditions by increasing or decreasing their holdings. By analyzing the reasons behind the movements of these whales, it is possible to infer Bitcoin price movements. For example, the following inferences can be made:

- Whales may react to market trends and adjust their holdings based on their analysis of market conditions.

- They may realize profits by selling a portion or all of their holdings when prices rise, or reduce their holdings in anticipation of price declines to minimize losses.

- Whales with large holdings can manage risks by adjusting their holdings in response to price volatility, decreasing their holdings in the face of expected price drops, and increasing their holdings when price increases are anticipated.

Therefore, by analyzing and interpreting the movements of these whales, it is possible to utilize them in inferring Bitcoin price movements. However, it is important to consider these analyses in conjunction with other market indicators and to conduct comprehensive analysis by considering various information and data for more accurate predictions.

The past trends of whale holdings changes can also be taken into consideration. While it may be hindsight, generally, large-scale investors tend to increase their holdings before upward movements or rebounds. Conversely, during market peaks or the beginning stages of declines, whales tend to decrease their holdings.

However, it is not appropriate to draw a simplistic and hasty conclusion that "whales are increasing their holdings, so prices will soon rise" and make investment decisions solely based on that. It is more reasonable to make informed judgments, considering that there are reasons or justifications behind the movements of these whales, who have shown agility in responding to the market.

Of course, speculating on the reasons behind the movements of whales, based on rational judgments, is more desirable than hastily concluding that they will lead to imminent price increases.

📌 Interpreting the Current Market Position through Wallet Holdings Analysis

- The price and market sentiment continue to be bearish, but whales holding over 1,000 BTC are increasing their holdings.

- While not a leading indicator for price, it is important to consider the characteristics and past behavior of each wallet group when making investment decisions.

Bitcoin's on-chain data can be helpful in inferring long-term trends rather than pinpointing short-term price movements or fluctuations. Furthermore, due to the transparent nature of on-chain data, the probability of false information or deception is significantly low, and real-time calculated data can be accessed.

However, it is important to note that different interpretations can arise from the same data, and it is advisable to use on-chain data as one of the various factors in investment decision-making rather than relying solely on it.