Dear all,

Bitcoin is consolidating near its previous ATH in Nov 2021. Let us bring you the customary NFT and digital market overviews for the past two weeks.

🌐 Two Weeks Market Brief

Bitcoin for the past 2 weeks ending 25th March fell -3.05%, Ethereum -11.67% but the rest of the market rose 2.13%. In a rare occurrence, alt-coins performed better than Bitcoin during this period.

Last week witnessed a consistent streak of five consecutive days marked by net outflows from the Bitcoin spot ETFs, exerting downward pressure on prices across the board. While Bitcoin remained stagnant, a real memecoin frenzy took center stage, particularly within the Solana chain ecosystem. Coins like $BOME surged a to a staggering billion-dollar market cap in just three days, epitomizing the fervor gripping the market. As Bitcoin’s price consolidates within its previous ATH range, there is ample opportunity for alt-coins to outperform in the weeks ahead.

Figure 1: ISM Manufacturing PMI seems to have bottomed / Source: Tradingeconomics

Despite data indicating a slight uptick in inflation in the US, Powell remained resolute during the March FOMC meeting affirming their confidence in curbing inflation. However, even some macro data such as ISM PMI and other leading indicators also suggest a potential rebound in the economy (Figure 1). The Fed’s response to this phase of the cycle remains pivotal since if they cut too early, it might reinvigorate inflation in the future. The dollar has been ticking up slightly in the past weeks which also warrants attention, especially in relation to risk assets.

NFT Market Overview

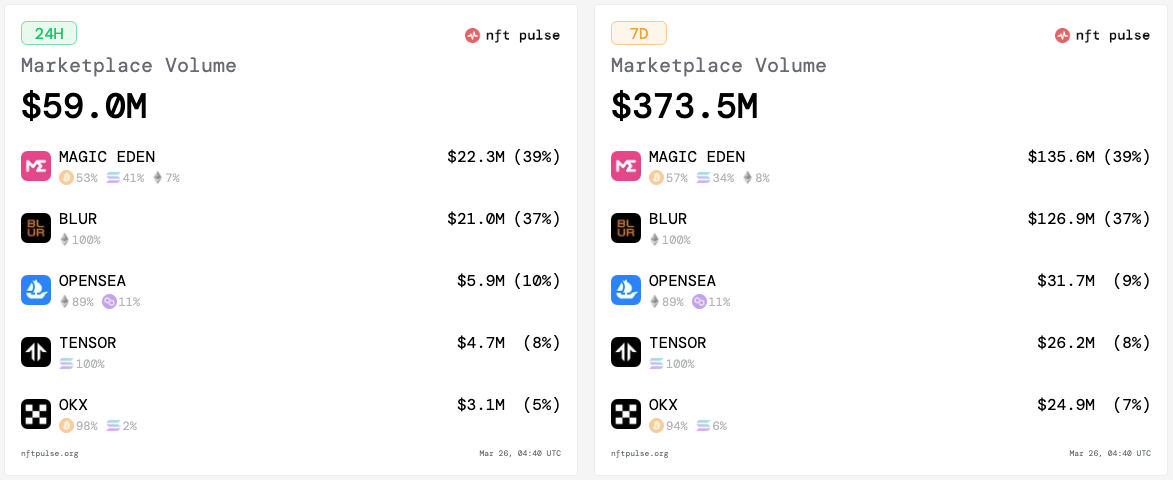

The Ethereum chain leads the daily NFT trading volume at $11.04 million, closely followed by Bitcoin at $11.04 million and Blast at $8.29 million, surpassing Solana at $5.34 million. Additionally, Base has risen to the top 5 chains based on NFT trading volume ($1.76 million), indicating the growing demand for Layer 2 chains.

Regarding Base, there was an event that introduced many people to the platform. XCOPY, an artist known for 1-of-1 glitch crypto art, released a 24-hour Open Edition "MUTATIO" on Base for 0.00069 ETH per piece. This attracted significant attention, resulting in 1,023,831 editions minted, generating nearly $2.5 million in total sales, accounting for 40% of the 7-day trading volume on Base.

In terms of NFT marketplaces, Magic Eden leads with a 39% market share, followed closely by Blur with 37%. This indicates the considerable impact of Bitcoin NFTs on trading volume. OpenSea, however, trails behind with a 9-10% market share.

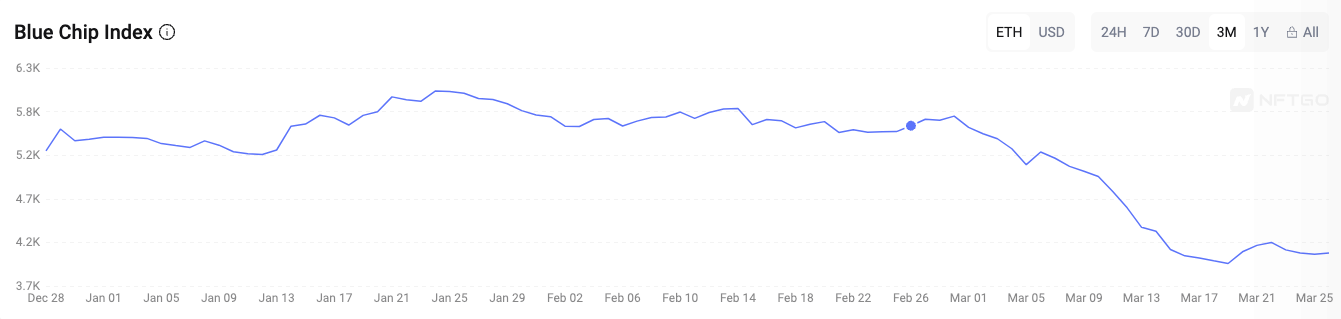

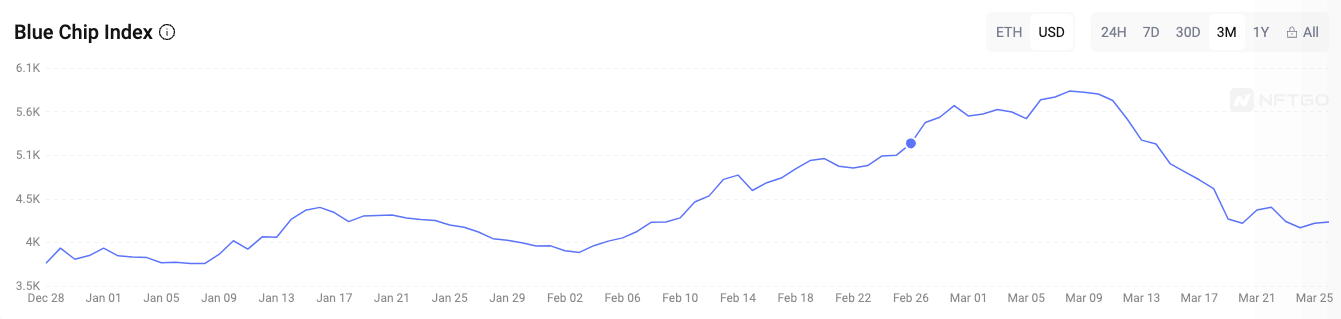

Here is the Blue Chip Index for Ethereum NFTs in both USD and ETH terms. In the past month, we observed a decoupling effect caused by the rise in Ethereum’s price, positively affecting the USD term but negatively impacting ETH terms. However, the USD term saw a decline in the past week, potentially due to fluctuations in the ETH price.

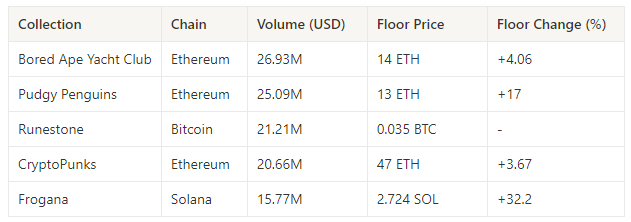

Here are the top 5 NFT collections across all chains based on trading volume over the past week, including the floor price and the percentage change in floor price for each collection. (This week, we decided to look beyond Ethereum based NFT collections to get a holistic view of the NFT market.)

Browsing through X(Twitter), it was interesting to see a post

highlighting the top 15 NFT collections by market cap. This demonstrates

the increasing demand and popularity of Bitcoin NFTs, with two making it

to the top 5 and one surpassing Bored Ape Yacht Club (BAYC), despite being

launched later than BAYC in December 2023.

Here are top five sales in the Ethereum NFT market in the past 7 days:

- CryptoPunk #7804: 4,850 ETH

- CryptoPunk #9206: 69 ETH

- CryptoPunk #5526: 62 ETH

- CryptoPunk #9002: 60 ETH

- CryptoPunk #2133: 57 ETH

Notable sales in the Ethereum Art NFT market in the past 7 days is as follows:

- Utility Stream by Botto: 45 ETH

- Ringers #324 by Dmitri Cherniak: 27.25 ETH

- Jack Butcher released a 24 hour Open Edition “1988 - The Physical Impossibility of Provenance” on Zora, resulting 148,464 editions minted for 0.0023 ETH each. The work draws visual inspiration from Damien Hirst’s famous piece and comments on the challenges of establishing provenance in the physical world.