Dear all,

Bitcoin touches to 57k amidst market exuberance. Let us bring you the customary NFT and digital market overviews for the last two weeks of February.

🌐 Two Weeks Market Brief

Bitcoin for the past 2 weeks ending 26th February rose 9.13%, Ethereum 19.4% and the rest of the market 9.43%. Ethereum and its related coins outperformed fueled by anticipation of its spot ETF.

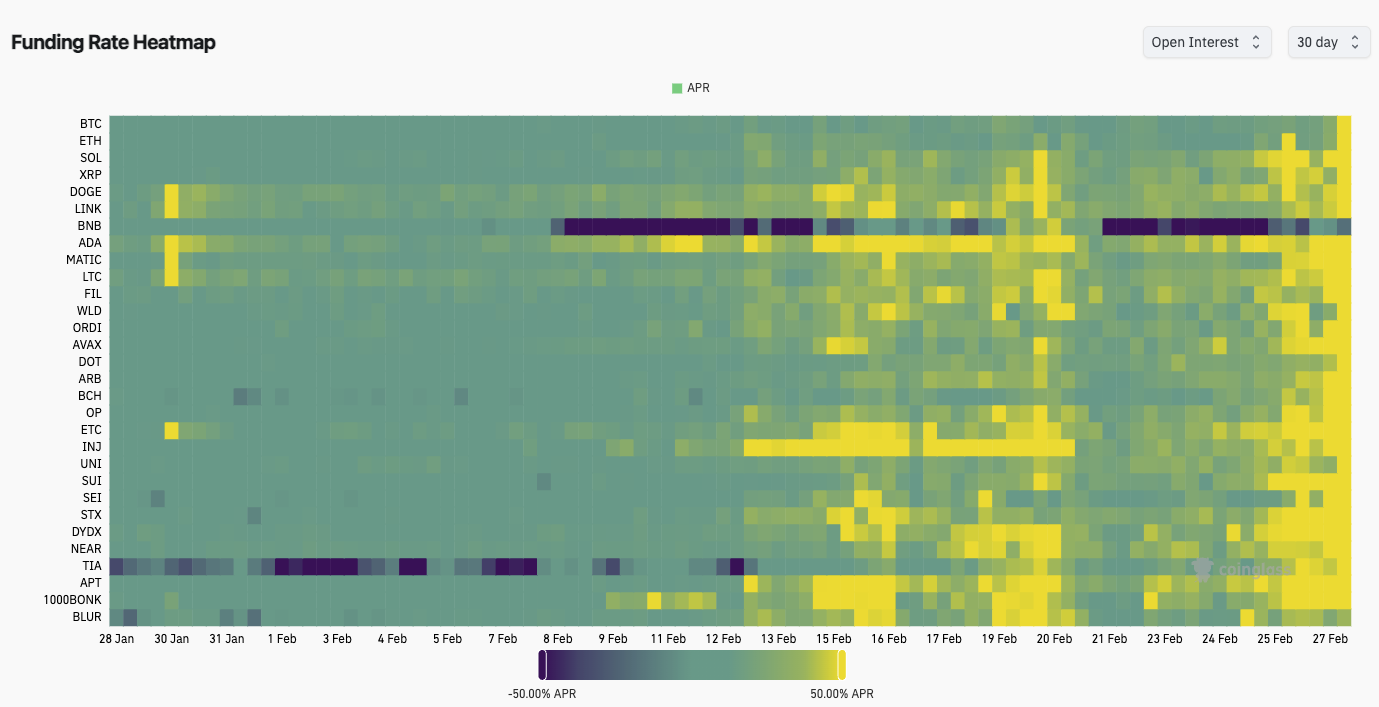

Strong inflows into the Bitcoin Spot ETFs fuelled rally, pushing Bitcoin to touch $57k this morning. As we tentatively suggested in the last newsletter, Ethereum outperformed mainly due to the anticipation surrounding its forthcoming spot ETF. The upcoming Dancun upgrade and robust activity on the network also bolstered Ethereum’s price surge. However, the funding rates are very high currently which might hint at excessive short-term excitement (Figure 1).

Figure 1: The funding rate is extremely high all across the board / Source: Coinglass

Both the US indices and the digital asset market appear indifferent to

macroeconomic factors right now. Inflation seems to be slightly more

sticky than analysts have expected, which has led pundits such as Larry

Summers to suggest the possibility of another rate hike. Nevertheless, the

risk sentiment seems unwavering particularly fueled by the AI narrative.

NFT Market Overview

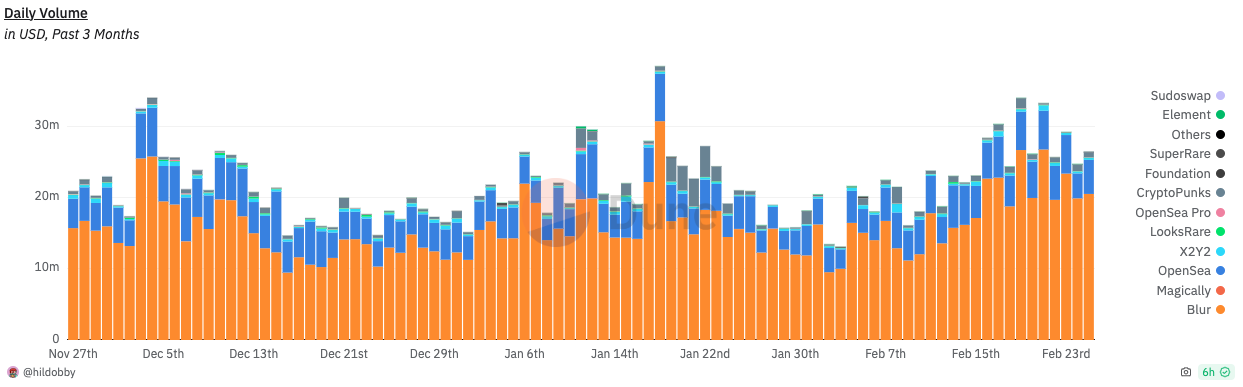

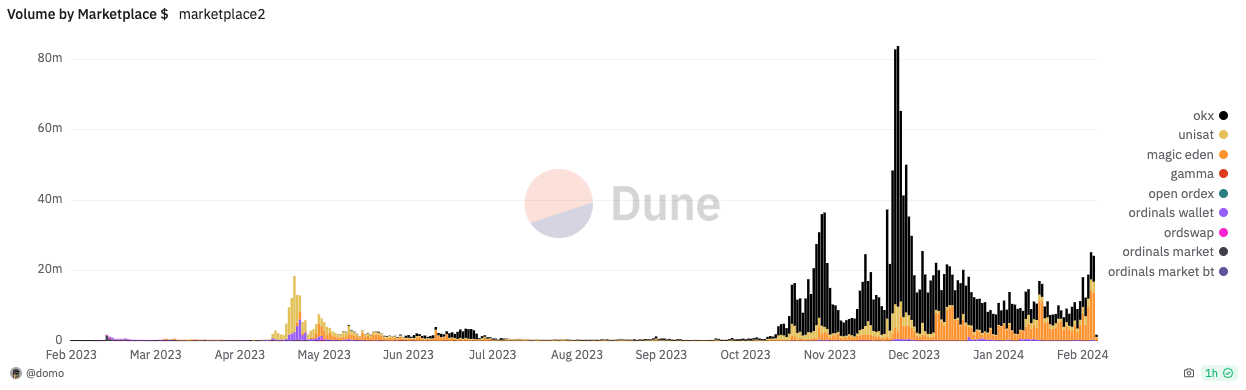

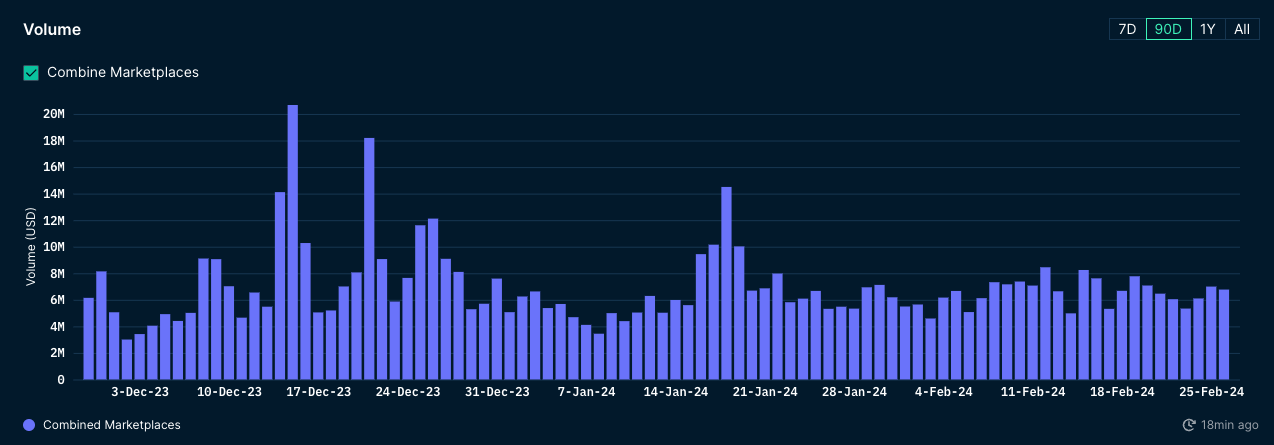

With the recent surge in Ethereum's price, the daily NFT market volume on Ethereum has also seen an upward trend, currently standing at $26.5 million, up from $21.4 million two weeks ago. Volume on Solana has remained relatively steady, standing at $6.7 million, extending from two weeks ago. The most significant increase is observed on Bitcoin's Ordinals platform, with volume soaring by 214% to $24.2 million, up from $7.7 million.

The Blue Chip Index, in both USD and ETH terms, shows a decoupling effect, as the rise in Ethereum's price affects the USD term positively while causing a decrease in ETH terms.

Here are the top 5 Ethereum collections based on trading volume over the past week, including the floor price and the percentage change in floor price for each collection. Notably, on February 17th, the floor price of Pudgy Penguins briefly surpassed that of the renowned Bored Ape Yacht Club (BAYC), reaching 22.2 ETH compared to BAYC's 22.1 ETH.

| Collection | Volume (ETH) | Floor Price (ETH) | Floor Change (%) |

|---|---|---|---|

| Pandora | 10,362 | 6.5 | +33 |

| Bored Ape Yacht Club | 8,453 | 23 | +5.19 |

| Mutant Ape Yacht Club | 6,427 | 4.02 | +1.21 |

| Sheboshis | 6,083 | 0.133 | +331 |

| Pudgy Penguins | 5,213 | 19 | -6.58 |

This demonstrates a momentary shift in the dynamic world of NFTs. Pudgy Penguins has been steadily increasing its influence, actively raising funds and selling toys directly to Web 2 customers in Walmart, leading to a 320% increase in its floor price since last November, from 5 ETH to 21 ETH.

Meanwhile, the floor price of BAYC has declined since its peak in April 2022, dropping from its all-time high of around 160 ETH to the current value of 22 ETH. The recent controversy surrounding BAYC's acquisition of Proof, an art-focused team best known for the Moonbirds collection, has caused concerns among the community about the dilution of the Yuga collection. However, BAYC experienced a recent price surge following the announcement that original co-founder Greg Solana would be returning to his role as CEO at Yuga Labs.

Additionally, NFTs made headlines in Paris last week with "NFT Paris," an annual event showcasing various activities including conferences, exhibitions, hackathons, and side events.

Here are top five sales in the Ethereum NFT market in the past 7 days:

- CryptoPunks #2954: 90 ETH

- Bored Ape Yacht Club #2333: 88 ETH

- CryptoPunks #5062: 75 ETH

- CryptoPunks #6094: 79 ETH

- Fidenza #901 by Tyler Hobbs: 75 ETH

In addition to the Fidenza sale mentioned earlier, another notable art NFT sale in the past 14 days worth highlighting is Ringers #314 by Dmitri Cherniak, which sold for 65 ETH.