Dear all,

Significant net inflow into the Bitcoin ETFs drives prices higher. Let us bring you the customary NFT and digital market overviews for the first two weeks of February.

🌐 Two Weeks Market Brief

Bitcoin for the past 2 weeks ending 29th January rose 16.24%, Ethereum 14.77% and the rest of the market 6.20%. Bitcoin and Ethereum dominance rose during the period.

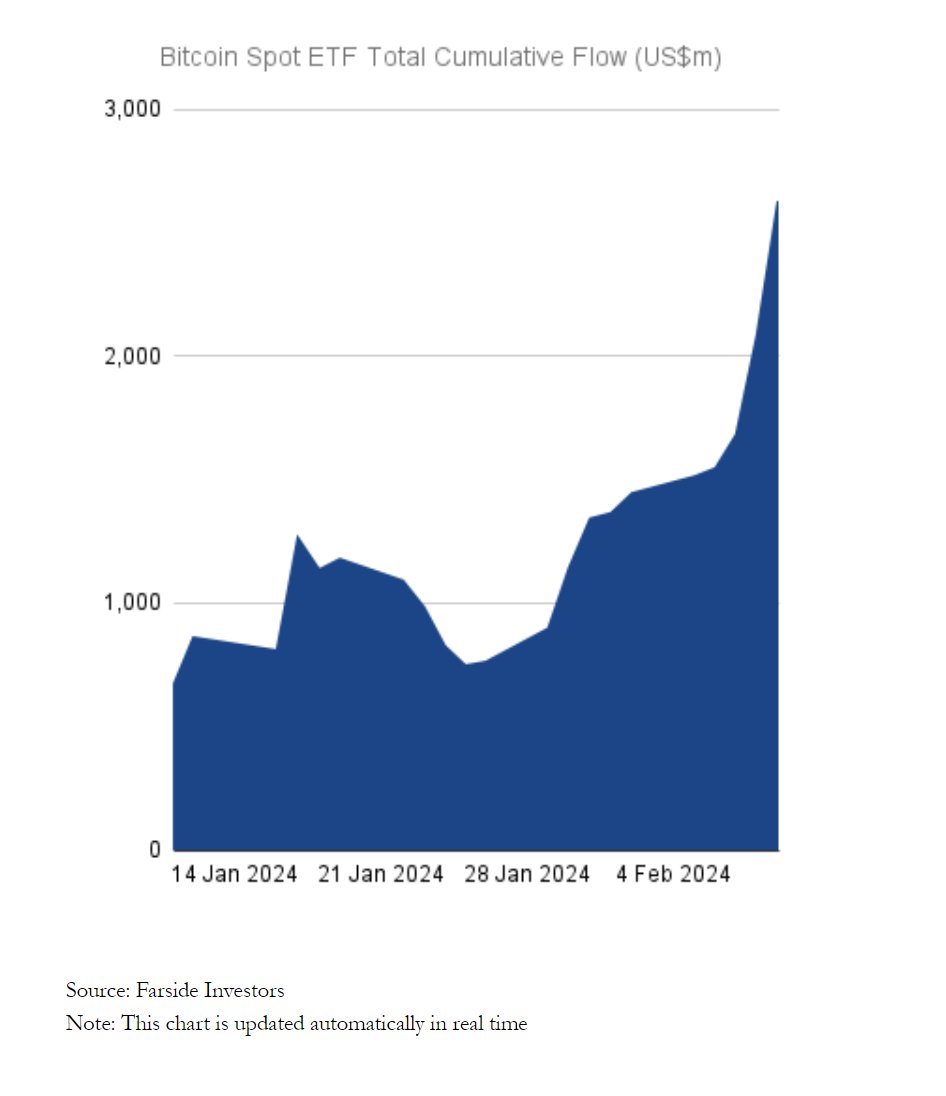

In the last newsletter we suggested that in the absence of a novel narrative, a potential catalyst for price escalation was a significant net inflow into the Bitcoin spot ETFs. This is what happened. Last Friday saw the biggest net inflow since the inception day with over $500M of fresh capital entering the ETFs. Should this continue, it promises robust support for the overall market with Ethereum and its L2s potentially the biggest beneficiary especially in light of the Dancun upgrade scheduled for 13th March.

Figure 1: Cumulative inflows into the Bitcoin spot ETFs rise sharply / Source: Farside Investors

The macroeconomic outlook appears less favorable as we look ahead, with

both the dollar and US interest rates showing a rising trend.

Nevertheless, with the US stock indices at all-time-highs, risk appetite

seems to have remained resilient. US CPI numbers come out today which are

projected to show a “2 handle” for the first time in several

years, which is obviously favorable for digital assets.

NFT Market Overview

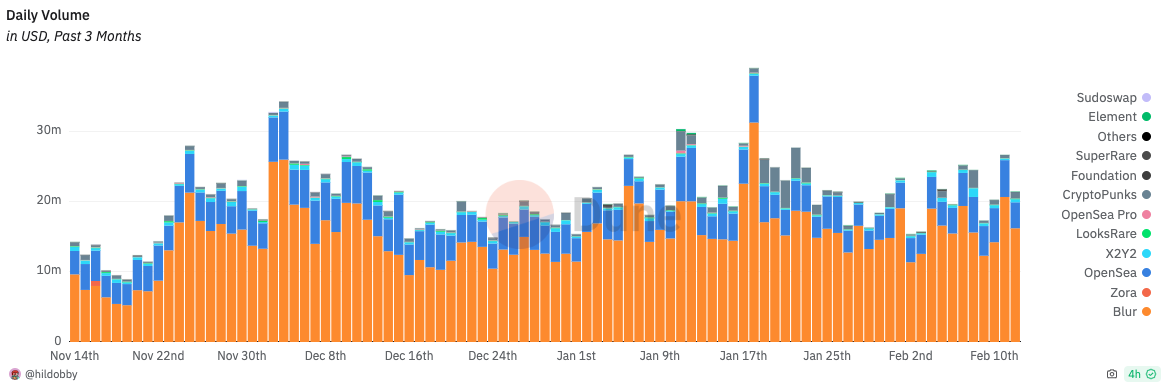

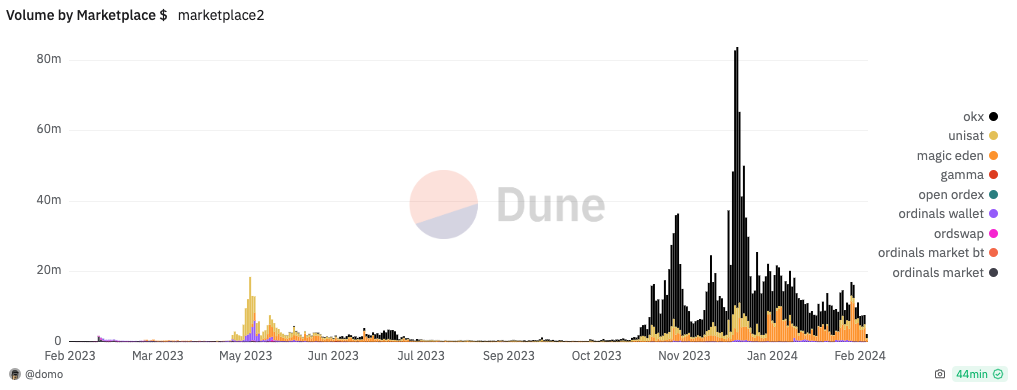

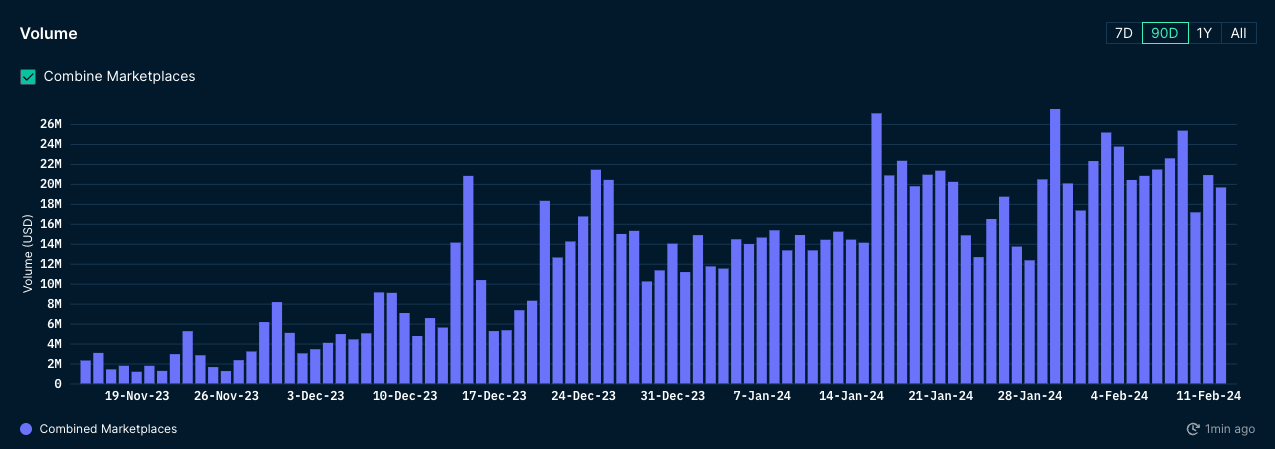

The market is showing a downtrend across three major chains. The daily NFT market volume on Ethereum has recently fluctuated, sometimes surpassing and at other times dropping below the $20 million mark. Currently, it stands just above this threshold, at $21.4 million, which is slightly higher than what we saw two weeks ago. Volume on Bitcoin Ordinals and Solana has also decreased compared to two weeks ago, with Ordinals down to $7.7 million and Solana at $19.6 million, down from $22 million.

Solana daily NFT volume / source: nansen.ai

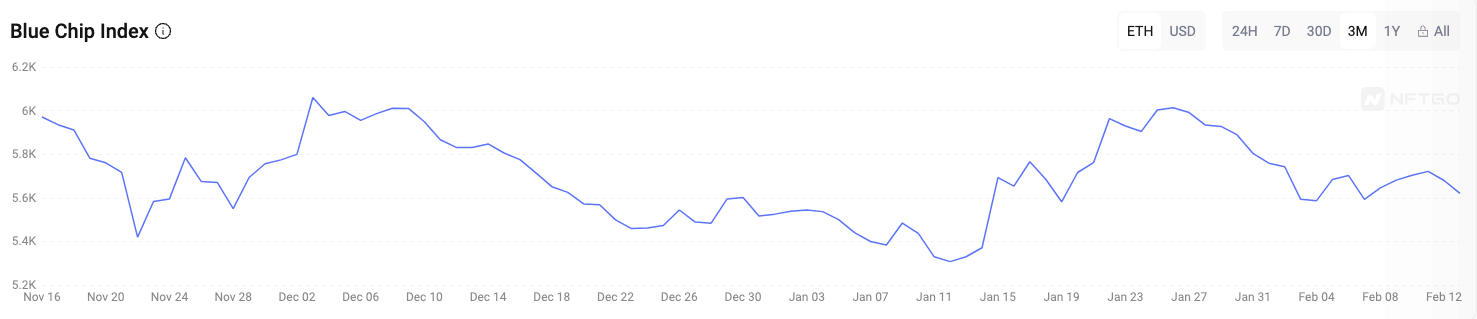

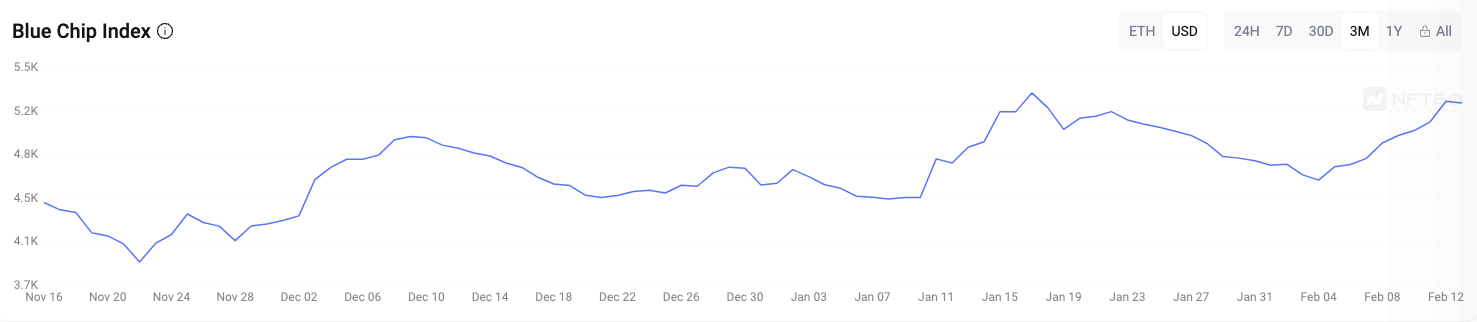

Looking at the Blue Chip Index, we are up from two weeks ago in ETH terms, but up in USD terms due to rise in the price of Ethereum.

Here are top 5 Etheruem collections based on trading volume over the past week including the floor price and the floor change(%) of each collection.

| Collection | Volume (ETH) | Floor Price (ETH) | Floor Change (%) |

|---|---|---|---|

| Pandora | 59,191 | 9.8 | +165 |

| Alphabet | 18,032 | 0.48 | -61 |

| Monarch | 12,195 | 0.37 | +247 |

| DeFrogs | 11,440 | 19 | +763 |

| Pudgy Penguins | 7,324 | 19 | +34 |

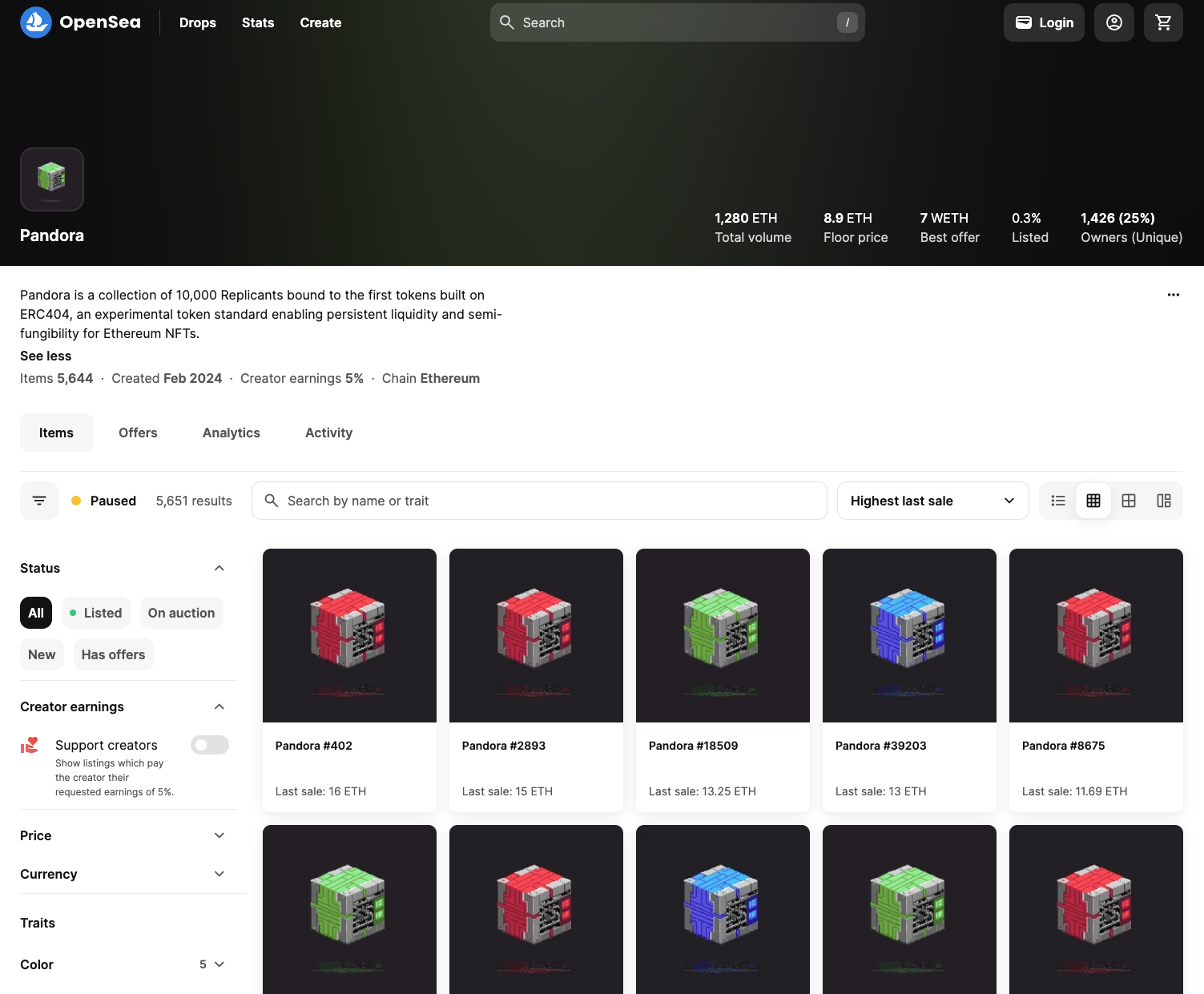

From the table above, it is noticeable that four new collections have overtaken the blue-chip collections and risen to the top positions in the Ethereum market in the past 7 days, despite being only 3-10 days old. What these collections (Pandora, Alphabet, Monard, and DeFrogs) all have in common is that they are all based on ERC-404. This is a new Ethereum standard that combines elements from both the ERC-20 (for token issuance) and ERC-721 (for NFTs) standards. This has gained massive appeal lately because of its innovative element, allowing multiple wallets to directly own a single NFT, which differentiates it from traditional NFTs. The top collection that resulted in the most volume, Pandora, is the first token based on ERC-404. The "first-ever" always garners the most attraction due to its pioneering nature.

Here are top five sales in the Ethereum NFT market in the past 7 days: despite the ERC-404 craze, the top sales are derived from the same bluechip collections as before, but with an exception - Ether Rock.

- Bored Ape Yacht Club #172: 275 ETH

- Wrapped Ether Rock #46: 200 ETH

- CryptoPunks #9736: 99 ETH

- CryptoPunks #735: 95 ETH

- CryptoPunks #8379: 82 ETH

In addition, here are top Art NFT sales that occurred in the past 7 days:

- Fidenza #606 by Tyler Hobbs: 70 ETH

- Fidenza #139 by Tyler Hobbs: 68 ETH

- Fidenza #139 by Tyler Hobbs: 66 ETH