Dear all,

Bitcoin rebounds but has the local top been reached? Let us bring you the customary NFT and digital market overviews for the last two weeks of January.

🌐 Two Weeks Market Brief

Bitcoin for the past 2 weeks ending 29th January rose 1.93%, Ethereum fell -7.73% and the rest of the market also fell -1.03%. Bitcoin rebounds from a 38.5k low as selling pressure from Grayscale’s ETF gradually diminishes.

Contrary to our initial expectations, $ETH underperformed $BTC over the past two weeks. This can be attributed to the market’s optimism regarding an Ethereum spot ETF in the US significantly dropping. Analysts’ perspectives on the matter vary, but lately, an increasing number of headlines suggest that the likelihood of it not proceeding is high. In the absence of the Ethereum spot ETF story, the market might struggle in identifying fresh narratives that could potentially drive prices higher once more. One factor that could alter this dynamic is a substantial net inflow into the Bitcoin spot ETFs, which would provide support to the overall market.

Figure 1: The dollar rises due to decreasing rate cut expectations / Source: Tradingview

Both the most recent US GDP and CPI numbers came higher than expectations,

leading March rate cut probabilities to fall from over 70% a month ago to

48.7% as of today. As a result, the dollar has been on a steady rise

(Figure 1). Geopolitical factors in the Middle East may have also played a

role in bolstering the dollar’s strength. While there are

indications of potential easing (for instance from China), the prevailing

strength of the dollar suggests that the performance of digital assets may

remain subdued.

NFT Market Overview

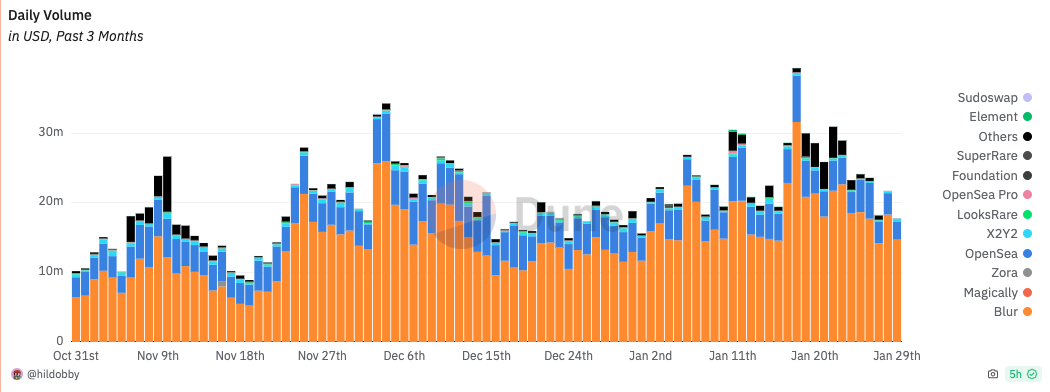

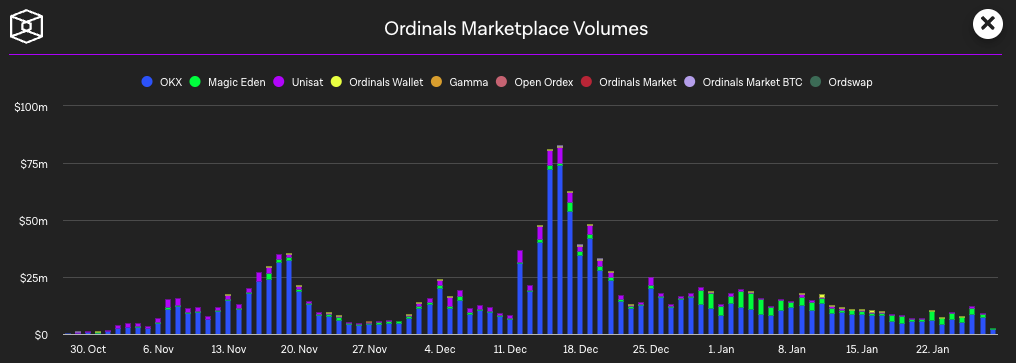

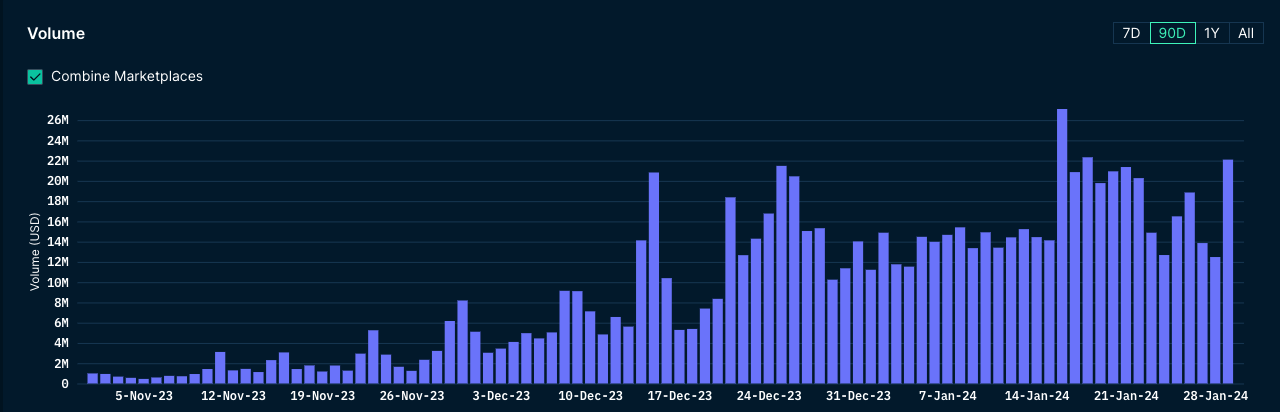

The Ethereum daily NFT market volume is showing a downward movement lately, going below $20 million mark at $17.8 million, way below what we have seen two weeks ago. This movement isn’t only evident in Ethereum but also in Bitcoin Ordinals as it is down to $9.34 million from $11.2 million two weeks ago. Solana, on the other hand, saw a rise in volume compared to two weeks ago, up to $22 million from $15.6 million.

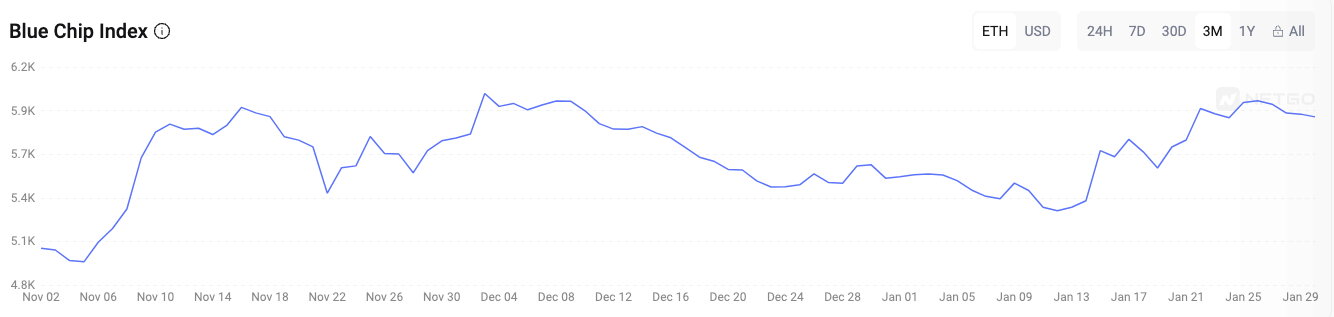

Looking at the Blue Chip Index, we are up from two weeks ago. However, the index seems to be forecasting a downward trend.

Here are top 5 collections based on trading volume over the past week including the floor price and the floor change(%) of each collection.

| Collection | Volume (ETH) | Floor Price (ETH) | Floor Change (%) |

|---|---|---|---|

| Azuki | 12,218 | 6.89 | -2.94 |

| Mutant Ape Yacht Club | 9,716 | 4.28 | -4.08 |

| Pudgy Penguins | 8,003 | 17 | -6.91 |

| LilPudgys | 4,173 | 1.69 | -6.91 |

| DeGods | 3,833 | 2.95 | -2.96 |

Here are top five sales in the Ethereum NFT market in the past 7 days:

- CryptoPunks #6505: 205 ETH

- CryptoPunks #5034: 89 ETH

- CryptoPunks #4285: 89 ETH

- CryptoPunks #5831: 81 ETH

- CryptoPunks #3229: 80 ETH

In addition, here are top Art NFT sales that occurred in the past 7 days:

- Fidenza #858 by Tyler Hobbs: 69.42 ETH

- Ringers #698 by Dmitri Cherniak: 40 ETH

- Ringers #972 by Dmitri Cherniak: 40 ETH