Dear all,

Blackrock files for an Ethereum spot ETF. Let us bring you the customary NFT and digital market overviews for mid-November.

🌐 Two Weeks Market Brief

Bitcoin for the past 2 weeks ending 20th November rose 6.86%, Ethereum 6.34% and the rest of the market 4.57%. Ethereum strives to close the gap with Bitcoin as Blackrock files for an Ethereum spot ETF.

The digital asset market sustained its upward momentum witnessing gains across the majority of coins/tokens albeit a slight retracement observed in some alt-coins. Ethereum particularly stood out as Blackrock officially filed for a spot Ethereum ETF on 16th Nov. Whether this bull market has more legs to run now hinges on Ethereum’s ability to maintain its bullish momentum while leading the way for other alt-coins. If the ETH/BTC chart (Figure 1) finds support here then it might signal the potential for a significant run up ahead of us similar to 2021. If not, the announcement of BTC spot ETF in January could be seen as the potential top for this cycle.

Figure1: ETH/BTC chart. Could it be bottoming? / Source: Tradingview

The overall macro backdrop appears favorable for digital assets with declining bond yields and a weakening dollar, mainly driven by expectations of a Federal Reserve policy pause. The market’s concerns seem to be pivoting from rate hikes to a potential recession partly fueled by signs of weakness in the labor markets. But so far, this is being received favorably by traders.

NFT Market Overview

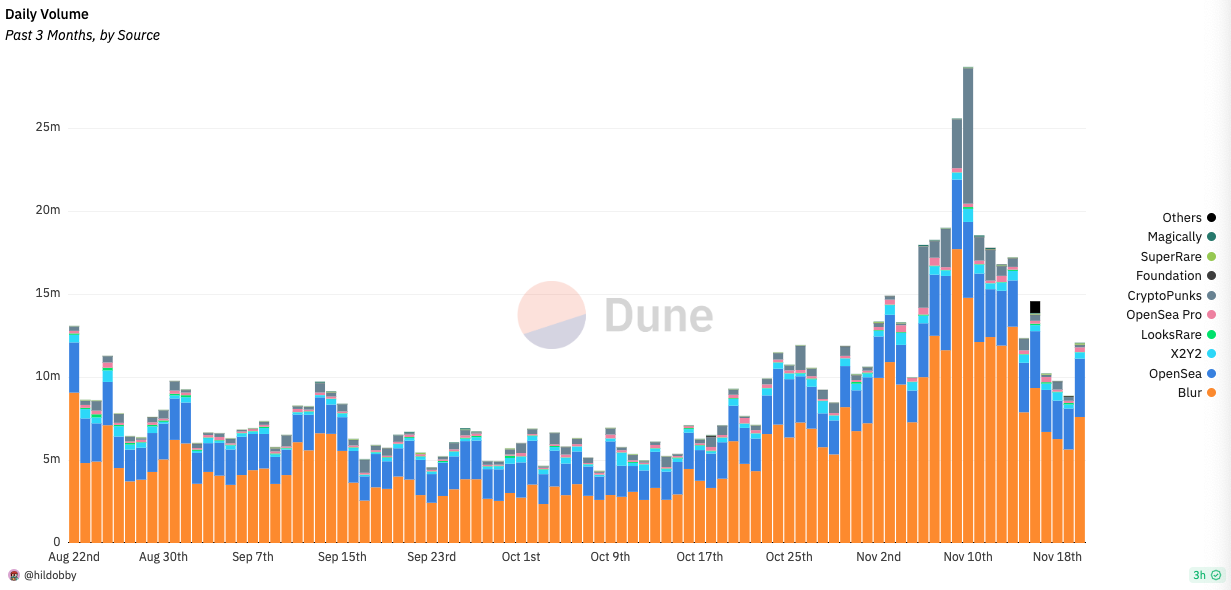

It is clear from the Ethereum market volume that we are down from the recent rally. The daily volume increased slightly yesterday ahead of the Blur Airdrop Season 2. However, right now, the daily volume stands at $12 million, down from $19.5 million two weeks ago.

The blue chip index has tilted from the peak, showing the start of a downtrend.

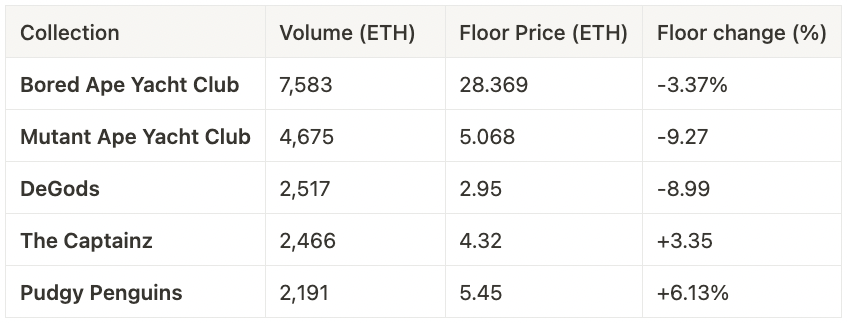

Here are top 5 collections based on trading volume over the past week including the floor price and the floor change(%) of each collection. It can be observed that The Captainz is maintaining its position in the top collection from its recent $MEME coin airdrop.

Since the last newsletter, there were many trades of Art NFTs taking place in the market. On November 10th, Gordon Goner, the Co-Founder of Yuga Labs, went on a shopping spree buying up notable Art NFTs including Fidenza #534 for 79 ETH and Chromie Squiggle #622 for 36 ETH. Several Fidenzas have been sold since then, notable one being Fidenza #812 collected by Curated and Fidenza #456, which was bought by a notable NFT collector Seedphrase for 110 ETH less 24 hours ago. The collector also bought other notable generative art collections in the past few days including some Chromie Squiggles (floor price 9.4 ETH) and The Harvest (floor price 4.49 ETH).

In addition to all the art sales that took place publicly on marketplaces, there were some private sales that took place at Sotheby’s. This includes sales of works from the Starry Night Collection, the collection that Three Arrows Capital amassed with a purpose to create a fund that represent “the world’s finest collection of Crypto Art”. An anonymous collector bought 7 works including Dmitri Cherniak’s “A slight lack of symmetry can cause so much pain”, which 3AC initially bought for 500 ETH. Curated also bought 2 works, which includes Matt DesLauriers’ Meridian #171, a.k.a. “Prime”, a rare trait that only 8 of them exist in the collection.

The transition of a buying trend from PFP NFT collections to Art NFTs isn’t something new. In fact, collectors have been more tilted towards buying art in the bear market we are living in right now. However, notable figures and collectors paying more attention to Art, and majority of the big sales happening on the art side rather than PFPs(as shown in the top five sales below) is something new that’s worth mentioning.

Here are top five sales in the NFT market in the past 7 days:

- Fidenza #456: 110 ETH

- Fidenza #525: 85 ETH

- CryptoPunks #3914: 80 ETH

- Fidenza #670: 72.5 ETH

- CryptoPunks #6051: 71.5 ETH