Welcome to Eric's Investment Diary with HEYBIT!

I look forward to investing alongside all of you, our HEYBIT customers,

until we all achieve our financial goals together!

My Investment

- Since my last post, Alpha has seen a lot of movement. On May 10th, Alpha dropped sharply, causing the almost +12% returns to fall to 0%. Fortunately, it bounced back within three days, nearly recovering to its original level.

- By increasing the leverage to 2x, the volatility of Alpha has indeed increased, but it is still on track. Yesterday, the US consumer price index showed very favorable numbers before the US presidential election, so I am optimistic that the crypto market will trend upwards for now, and I have a positive outlook on both Alpha and Beta HMI12 🚀🚀

- Today, a new product called Alta, which combines the Alpha Binance and Beta HMI12 products, was launched. This product allows flexible adjustment of the ratio of the two strategies in three different ways to respond to market conditions. I plan to monitor Alta's performance over the next week and consider switching to it accordingly. Let’s see!

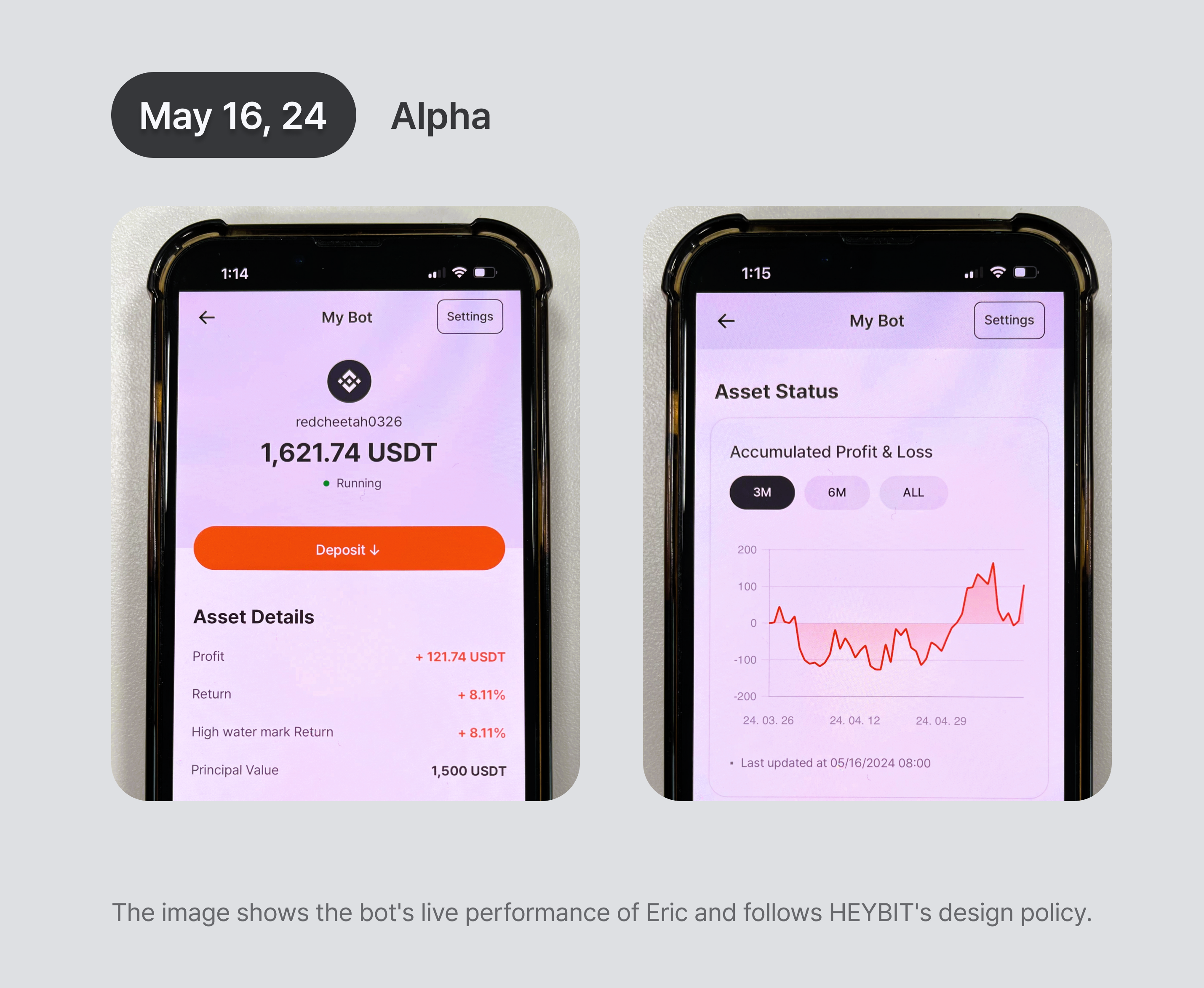

My Alpha status

-

Compared to Last week,

- Alpha’s Return : +7.61% → +8.11% (+0.5%p)

- Alpha’s PNL : +114.2 USDT → +121.74 USDT (+7.54 USDT)

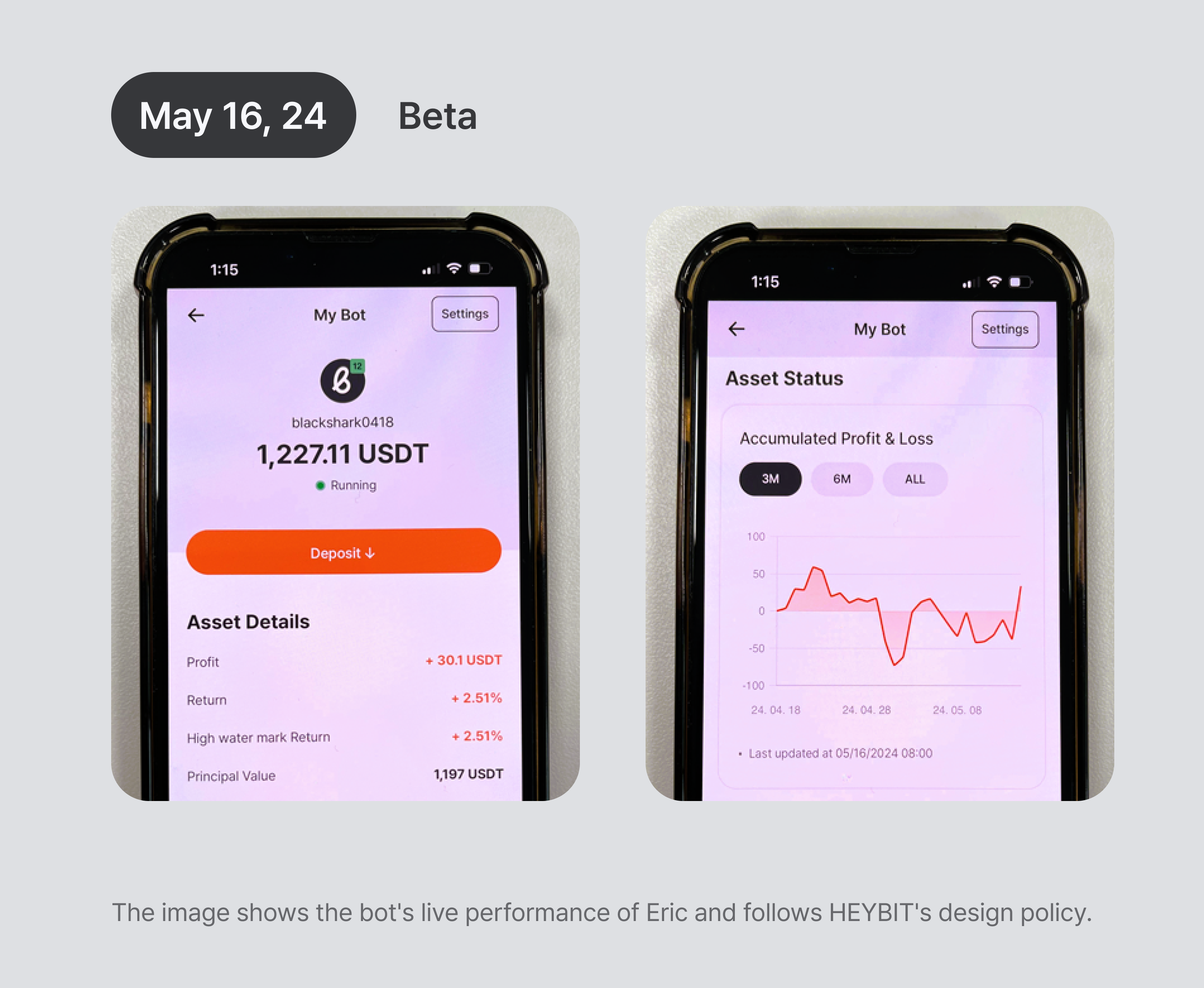

My Beta status

-

Compared to Last week,

- HMI12’s Return : -1.98% → +2.51% (+4.49%p)

- HMI12’s PNL: -23.75 USDT → +30.1 USDT (+53.85 USDT)

Market Overview

☀️ Strong Resistance: $67k.

Without any significant upward catalysts, the price of Bitcoin rose to $65.5k last week before plummeting back down to $60k. It then traded sideways for a few days until yesterday, when it surged from $61k to $66k in a single day, spurred by a slowdown in the CPI numbers. However, $67k represents a significant resistance level, so risk management is essential at this point. If Bitcoin breaks through $67k this week, I anticipate it could rise to $72k. After a period of consolidation, this could signal the return of a bull market.

☀️ Financial Times: "CME Preparing Bitcoin Spot Trading Service"

According to multiple sources cited by the Financial Times, the Chicago Mercantile Exchange (CME), the world's largest futures exchange, is preparing to launch a Bitcoin spot trading service. CME has been in discussions with trading institutions that seek regulated cryptocurrency trading. Although not finalized, the service is expected to attract significant investments from Wall Street. CME declined to comment on the matter.

☀️ Caixin: "Hong Kong Cryptocurrency ETFs Could Reflect China's National Strategy"

Caixin, a Chinese economic media outlet, reported that many Hong Kong-based cryptocurrency ETF issuers are directly guided by Chinese regulatory authorities. The report suggests that Hong Kong's cryptocurrency experiments align with China's national strategy. If these ETFs operate smoothly and demonstrate effective risk control, there is a possibility that mainland Chinese investors might be allowed to invest in Hong Kong cryptocurrency ETFs in the future.

☀️ US Institutions Hold Over $4.5 Billion in Bitcoin Spot ETFs

Julian Fahrer, co-founder of Flowstate, shared on X that the top 10 institutions holding Bitcoin spot ETFs collectively possess over $4.5 billion worth of Bitcoin. The leading holders include:

- Millennium Management: $1.8 billion

- Susquehanna International Group (SIG): $1.1 billion

- Bracebridge Capital: $404 million

- Boothbay Fund Management: $303 million

- Morgan Stanley: $251 million

- Ark Investment: $192 million

- Aristeia Capital: $152 million

- Wisconsin Investment Board: $151 million

- HBK Investments: $105 million

- Graham Capital: $93.75 million

☀️ US BTC Spot ETFs See Inflows of Approximately $300 Million

Data from financial information platform Farside Investors revealed that on the 15th of this month, US Bitcoin spot ETFs saw inflows of around $300.3 million. The largest inflow was into Fidelity's FBTC, with $131 million, followed by $27 million into GBTC. The inflow and outflow figures for BlackRock's IBIT are yet to be compiled.

☀️ Wall Street Bets on Two Interest Rate Cuts in September and December

Concerns about persistent inflation have diminished slightly after April's Consumer Price Index (CPI) showed a slight slowdown. The core CPI, a key measure of underlying inflation, hit its lowest rate in three years, raising hopes that the Federal Reserve might cut interest rates later this year. Wall Street is speculating on potential rate cuts in either September or December.

So…

- As mentioned earlier, with the US CPI showing signs of slowing down, expectations for two interest rate cuts this year are growing in the financial markets. This, along with the upcoming US presidential election, is likely to have a positive impact on the crypto market, potentially signaling the start of a new bull run. I will continue to monitor the performance of Alpha and Beta HMI12 until next week. If Alta, which was launched today, shows good returns by then, I plan to move funds from Beta HMI12 to Alta. Wishing everyone successful investments until next week!

Updated on May 16, 2024