Welcome to Eric's Investment Diary with HEYBIT!

I look forward to investing alongside all of you, our HEYBIT customers,

until we all achieve our financial goals together!

My Investment

- Last week, Alpha really held up well, while Beta continues to struggle as the market keeps declining. I'm hoping for a swift recovery in the market.

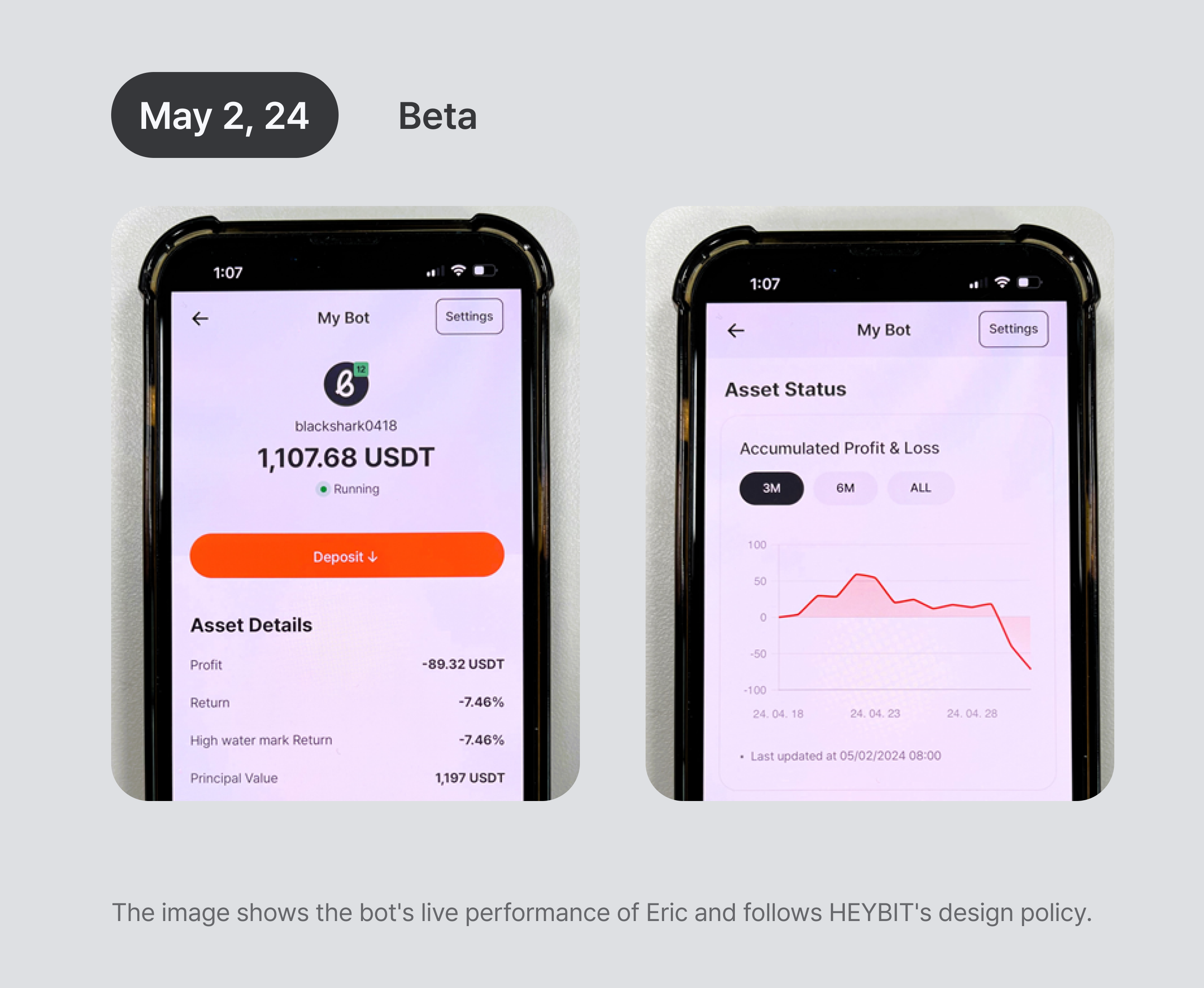

My Beta

-

Compared to Last week,

- HMI12’s Return : +1.78% → -7.46% (-9.24%p)

- HMI12’s PNL: +21.38 USDT → -89.32 USDT (-110.7 USDT)

- The market is not doing well, and Beta is also struggling. It's a very tough market for me too.

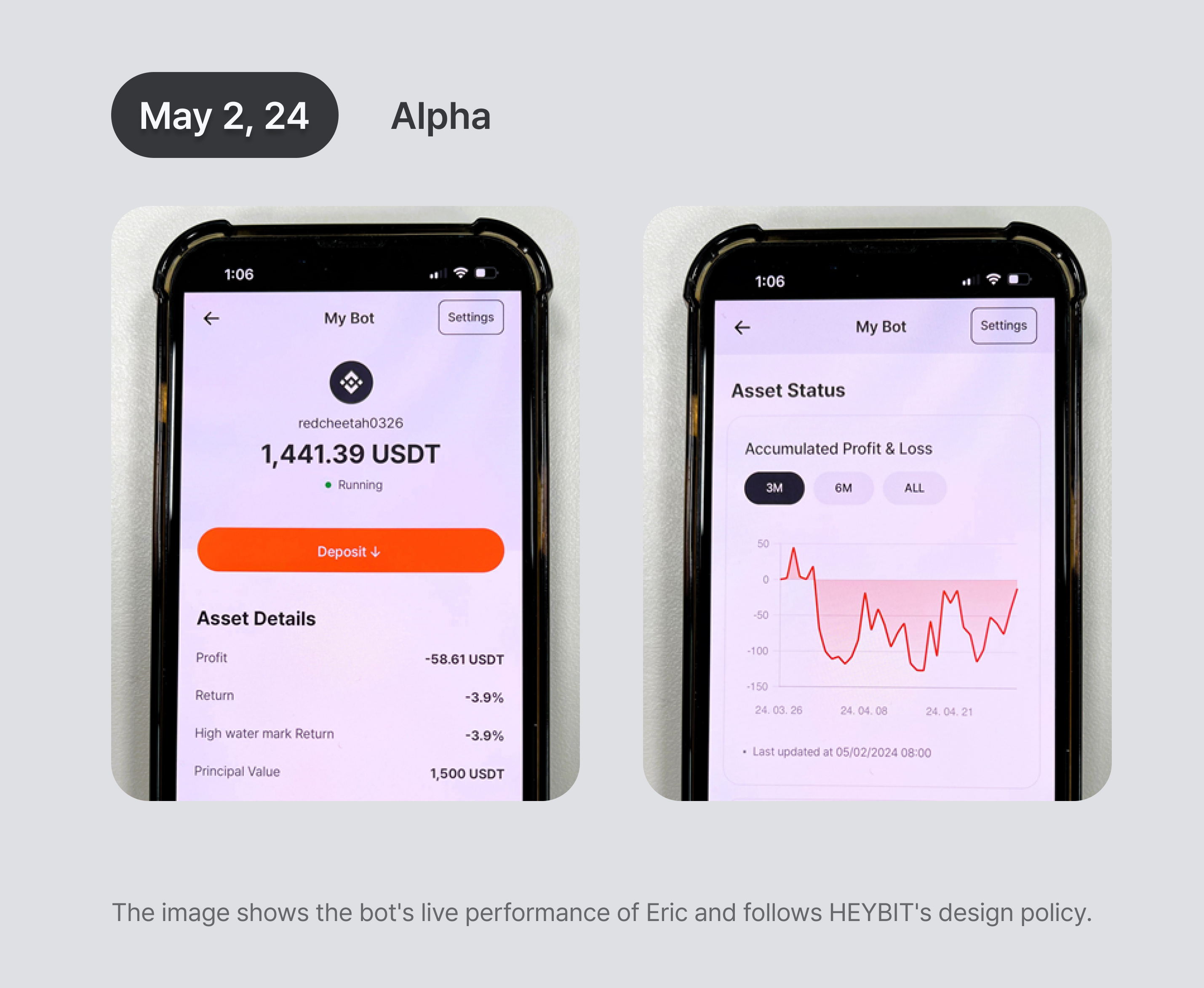

My Alpha

-

Compared to Last week,

- Alpha’s Return : -6.90% → -3.90% (+3.00%p)

- Alpha’s PNL : -103.55 USDT → -58.61 USDT (+44.94 USDT)

- Last week, I increased the leverage of the Alpha strategy to 2x, yet it has continued to perform impressively despite the tough market conditions. Initially, my investment in Alpha was intended to hedge against Beta, and seeing it work effectively has brought me some relief.

Market Overview

⛈️ Disappointment Over Hong Kong ETF Trading Volumes

Today marked the launch of six new Bitcoin ETFs in Hong Kong, which fell significantly short of expectations, bringing widespread disappointment to the cryptocurrency industry. Market projections estimated the trading volume on the first day to reach around $125 million; however, the actual volume amounted to just $11 million, which is merely one-tenth of the expected figure, exerting downward pressure on the broader cryptocurrency market.

⛈️ Record Outflow from US Bitcoin Spot ETFs

US Bitcoin spot ETFs witnessed a record outflow of over $559 million. This is the largest amount since the listing of BTC spot ETFs in January and marks six consecutive days of net outflows. The figure nearly doubles the previous record outflow of $326 million on March 19. BlackRock's IBIT recorded its first net outflow of $36.9 million, while Fidelity's FBTC saw an outflow of $191 million. Grayscale's GBTC reported an outflow of $167 million.

🌧️ FOMC Maintains Interest Rates

The Federal Open Market Committee (FOMC) announced the decision to keep interest rates unchanged at 5.25-5.50%, aligning with market expectations.

⛈️ Powell: "Unsatisfactory Inflation Data This Year.”

Federal Reserve Chairman Jerome Powell commented in a post-FOMC press conference, "This year’s inflation data has not been satisfactory. It may take longer than we previously anticipated to gain greater confidence in inflation trends. So far, the inflation data released this year has not given us that confidence." He continued, "We will maintain the current interest rates until we are confident of progress towards the 2% inflation target."

⛈️ Crypto 'Fear and Greed Index' Hits 43, Shifts from Neutral to Fear After Six Months

Due to various negative factors, investor sentiment has deteriorated, shifting from neutral to a state of fear.

🌦️ Important Price Range: $50k-$57k, Potential Drop to $50k if No Rebound from Current Levels

Bitcoin has recently dropped to $56k after breaking below the $59k mark. If it rebounds from this level back up to $59k, it could continue to rise. However, if it declines further, there's a possibility it could drop as low as $50k. Nevertheless, the $50k level could represent a good opportunity for buying.

So…

- It's been a tough month with market corrections and high levels of difficulty. Alpha is showing respectable performance during these challenging times, but Beta, being a market-following strategy, continues to underperform. However, I believe there will be a rise soon and I am prepared to hold on. I hope that the market will begin to ascend again starting from the third quarter of this year.

Updated on May 2, 2024