Welcome to Eric's Investment Diary with HEYBIT!

I look forward to investing alongside all of you, our HEYBIT customers,

until we all achieve our financial goals together!

Market Overview

-

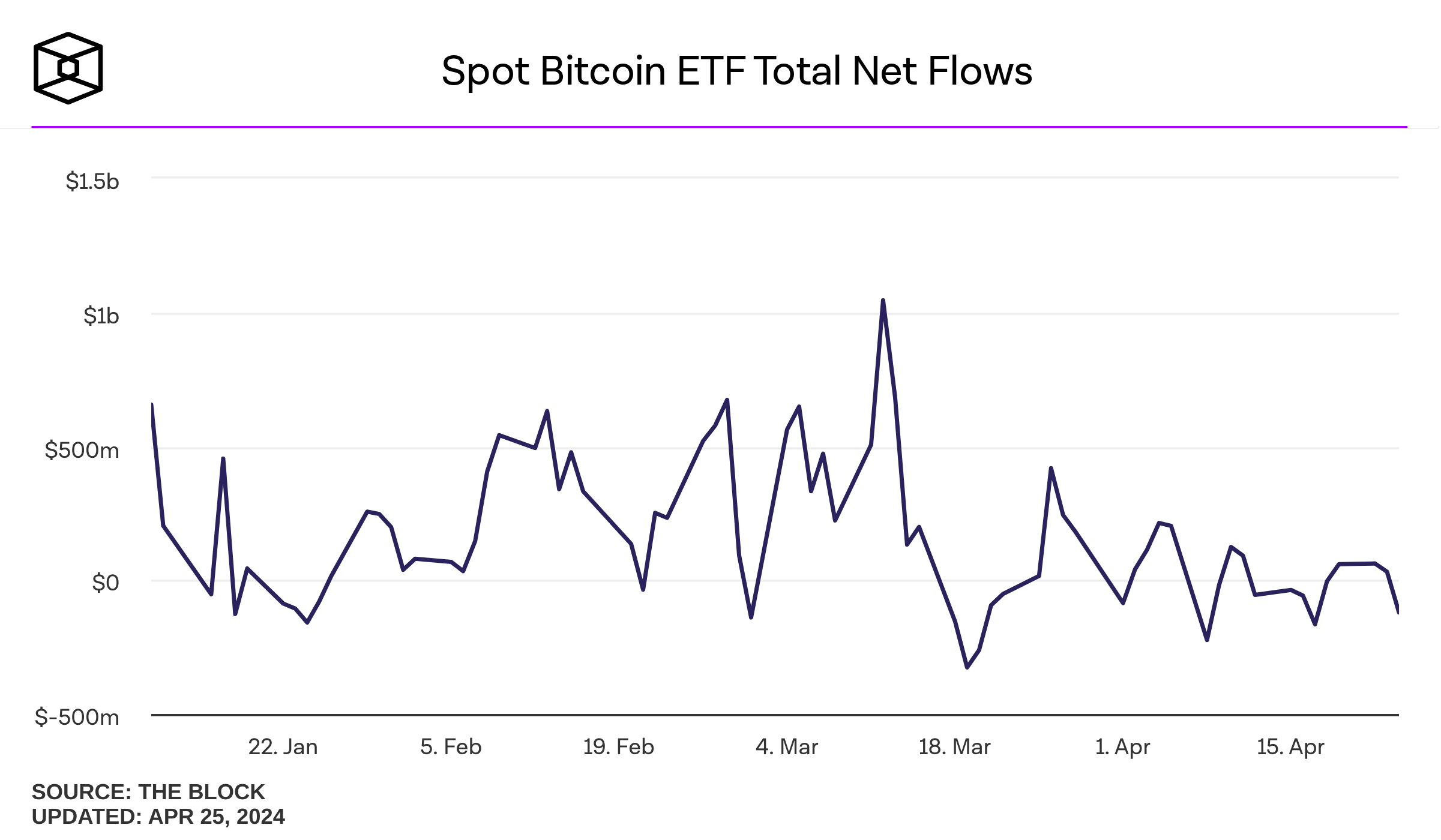

Sideways Trend in Bitcoin Due to Weakening Spot ETF Inflows

Currently, Bitcoin is trading sideways in the price range of $59k to $68k. It must break through $68k to potentially reach $80k. However, due to the current macroeconomic situation and geopolitical risks, Bitcoin is also showing mixed trends. The upcoming launch of spot ETFs of BTC and ETH in Hong Kong at the end of this month may inject some vitality into the market, depending on the inflows from these funds.

-

Biden Administration Faces Criticism Over 44% Tax Plan on Digital

Assets

This month, the Biden administration's proposal to impose a 44% tax on digital asset transactions has faced significant criticism in the U.S. According to Cryptopolitan, a digital asset-focused media outlet, the community is concerned that this tax plan could drive many digital asset companies and investors away from the U.S., potentially undermining its status as a global economic leader.

-

Bitcoin Whales Accumulate During Price Dip

Recent on-chain data revealed that Bitcoin whales have significantly invested in Bitcoin during the recent price correction, purchasing around 620 bitcoins last week with an investment of $38.9 million. This is part of a larger acquisition totaling approximately $282.38 million at an average purchase price of about $64,471.

-

Fears of Stagflation

In New York's stock market today, discussions on stagflation were reignited. The U.S. Department of Commerce reported that the GDP for the first quarter increased by only 1.6% annually, significantly lower than Wall Street's expectation of 2.4%. While economic growth has slowed more than anticipated, inflation rates have accelerated. The personal consumption expenditures (PCE) price index rose 3.4% year over year, and the core PCE price index, which excludes volatile food and energy prices, increased by 3.1%.

-

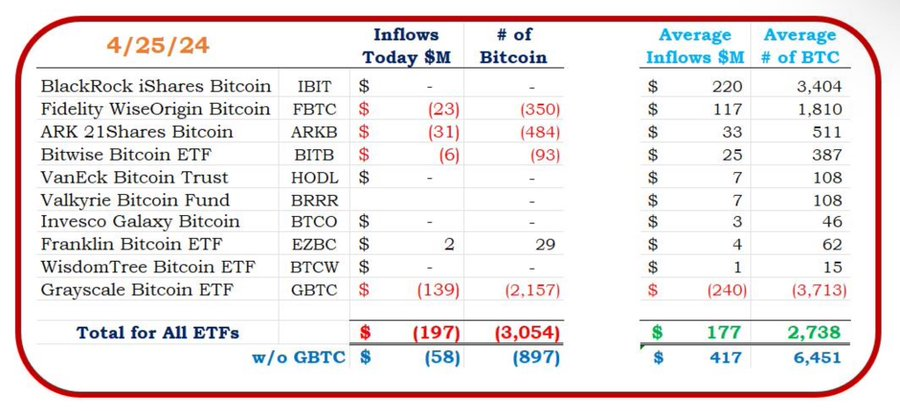

Net Outflows from BTC Spot ETFs, No Inflows into BlackRock's IBIT for

Two Days

The Bitcoin spot ETFs experienced net outflows of $120 million on April 25 and $197 million on April 26, while there have been no inflows into BlackRock's IBIT for two consecutive days, indicating a continued sideways movement in Bitcoin prices.

My Investment

- Last week, I terminated the HAI10 and started operating HMI12, which allocates about 80% of assets to Bitcoin and Ethereum, and 20% to the top 10 altcoins by market cap. Additionally, I've increased the leverage of the Alpha strategy to 2x.

- Given that the Beta strategies inherently carry more risk, I've decided to adjust the stop-loss line for HMI12 from -10% to -20%.

- The market has been quite unpredictable lately. I believe that a long-term investment approach is the most effective way to enhance profitability.

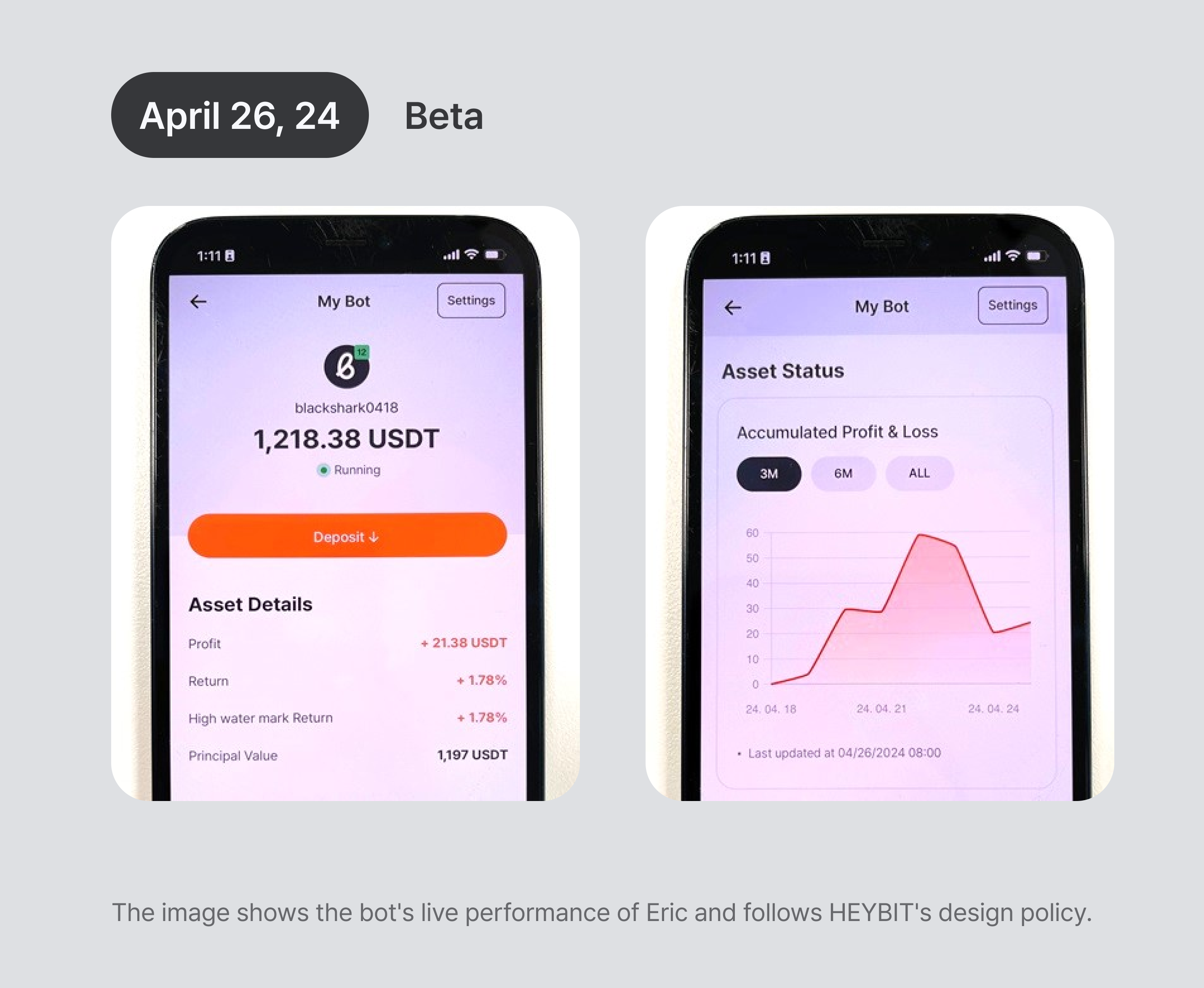

My Beta

-

Compared to Last week,

- HMI12’s Return : +1.78%p (-)

- HMI12’s PNL: +21.38 USDT (-)

- Currently, Bitcoin is not showing any significant movements, resulting in minimal fluctuations in returns. The market is really dull these days.

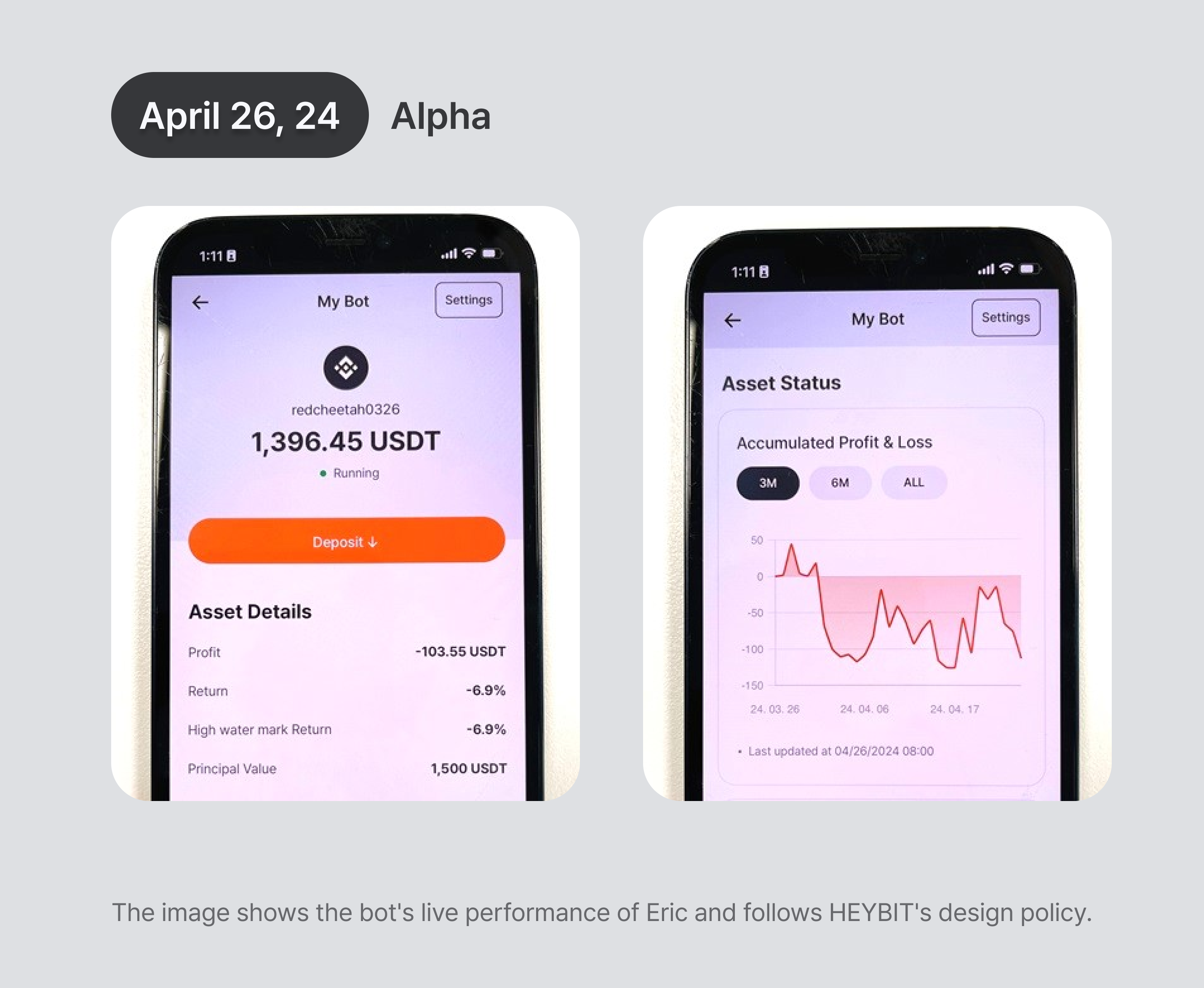

My Alpha

-

Compared to Last week,

- Alpha’s Return : -8.13% → -6.9% (+1.23%)

- Alpha’s PNL : -122.04 USDT → -103.55 USDT (+18.49 USDT)

- I've increased the leverage of the Alpha strategy to 2x. Although it initially showed gains during the investment period, the market has continued to be in chaos and has since declined. Additionally, due to the increased leverage in Alpha, there is greater volatility, so I am planning to adjust the stop-loss line from -15% to -20%.

So…

- The recent market volatility has made investing extremely challenging. If I had been trading futures by myself during this time, I likely would have been liquidated by now. I believe that 'buying the dip' and ‘long-term holding’ are the best strategies to increase win rates in the current market conditions. Let’s all persevere through this period!

Updated on April 26, 2024