Welcome to Eric's Investment Diary with HEYBIT!

I look forward to investing alongside all of you, our HEYBIT customers,

until we all achieve our financial goals together!

Market Overview

-

Geopolitical Risk

Due to the potential for an escalation of the conflict between Israel and Iran, as well as the broader instability in the Middle East, there has been a continuous increase in oil prices. This surge is exacerbating the burden of inflation, impacting global economies by raising the cost of goods and affecting financial markets.

-

Fed’s statement about current interest rates

Federal Reserve Chair Jerome Powell has stated that the current interest rates might be maintained if inflation does not subside. Meanwhile, Fed Vice Chair Jefferson has suggested that the high-interest rates could be sustained for a longer period, indicating a cautious approach towards the economic outlook and inflationary pressures.

-

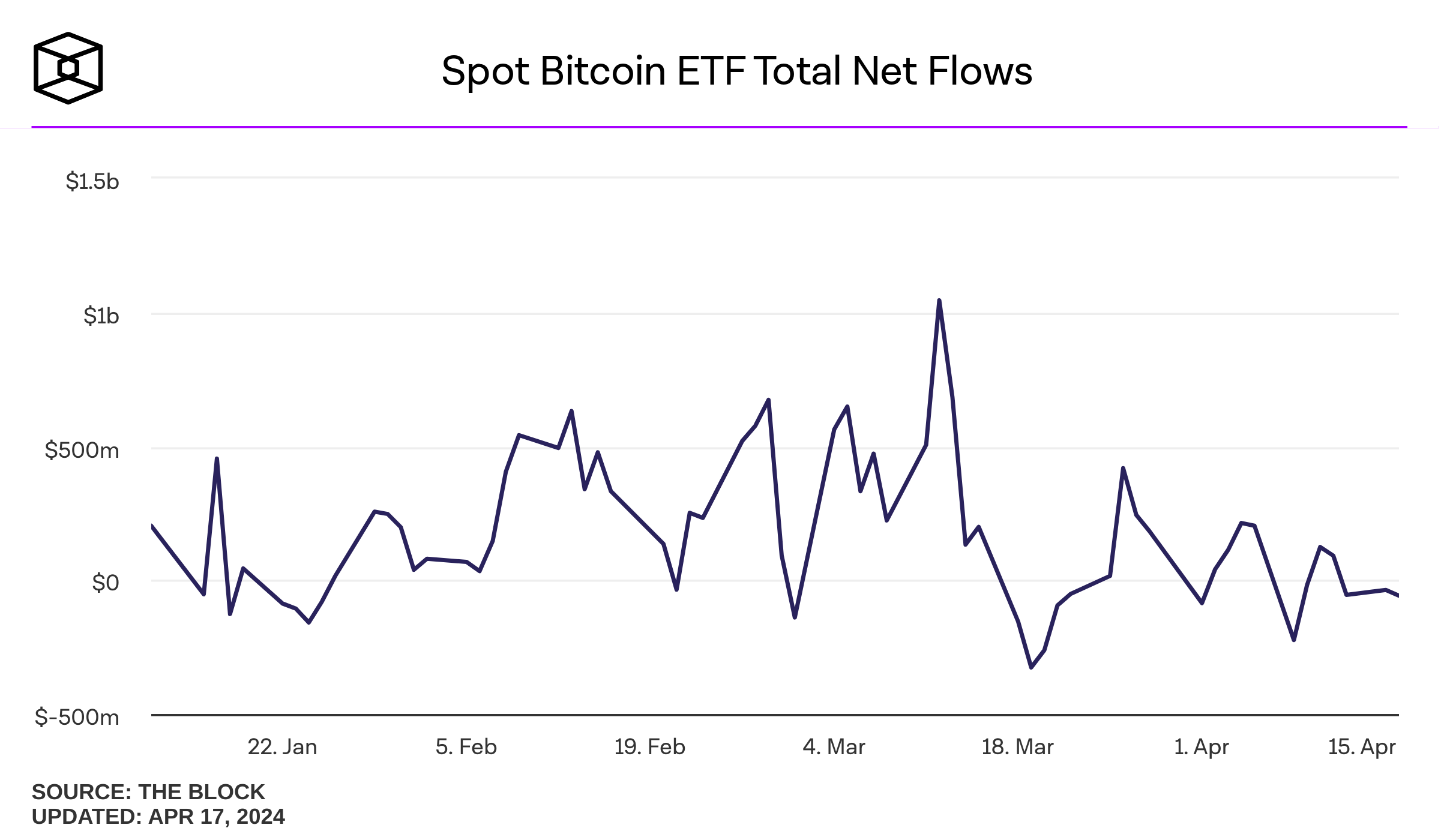

BTC Spot ETF net outflows

There have been net outflows from the BTC spot ETF for three consecutive days, indicating a negative situation.

-

Further decline to $52k is possible

Bitcoin has broken out of its trading range, dropping to $59k, but fortunately, it rebounded due to incoming buy orders. The $59k level is considered a critical zone, and if it breaks below this, there's potential for a further decline to $52k.

-

Altcoin Season may be delayed

Bitcoin dominance currently stands at around 55%, which is still very high. With the halving just two days away, it appears that Bitcoin dominance may remain elevated for some time, suggesting that it might take longer for an altcoin season to start.

My Investment

- Last week, the returns on HAI plummeted to around -20%, far surpassing my stop-loss threshold of -10%. Due to a busy schedule, I missed the optimal timing to sell, so I plan to sell today and purchase Beta HMI.

- I think I judged the arrival of the altcoin market too early, and since everyone's focus is still on Bitcoin, I intend to invest in Beta HMI, which has a high Bitcoin allocation. Additionally, I plan to increase Alpha's leverage to 2x for higher profitability. And I will adjust my stop-loss line of Alpha from -10% to approximately -15% to account for the increased leverage.

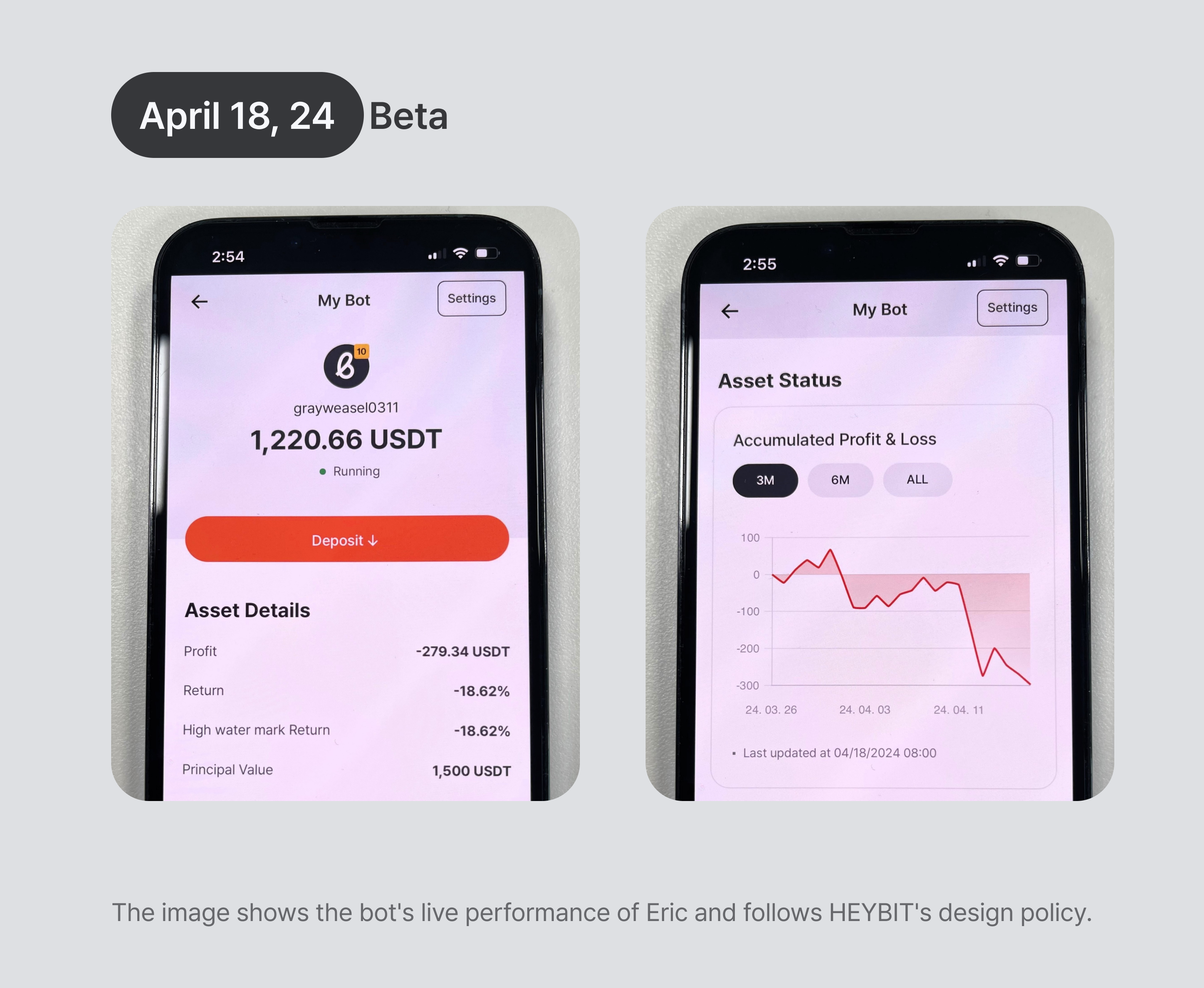

My Beta

-

Compared to Last week,

- HAI’s Return : -1.14% → -18.62% (-17.48%)

- HAI’s PNL: -17.12 USDT → -279.34 USDT (-262.22 USDT)

- As everyone knows, the altcoins crashed last week, and having invested in HAI, I was hit hard by the downturn. I missed the optimal timing to cut my losses, so I still hold the HAI, but I plan to sell all of it today. The proceeds will be invested in HMI, which allocates nearly 65% to Bitcoin.

-

Currently facing a loss of about 19%, I am feeling quite down,

acknowledging that this was my mistake. Moving forward, I intend to

monitor the markets more frequently to better time my trades.

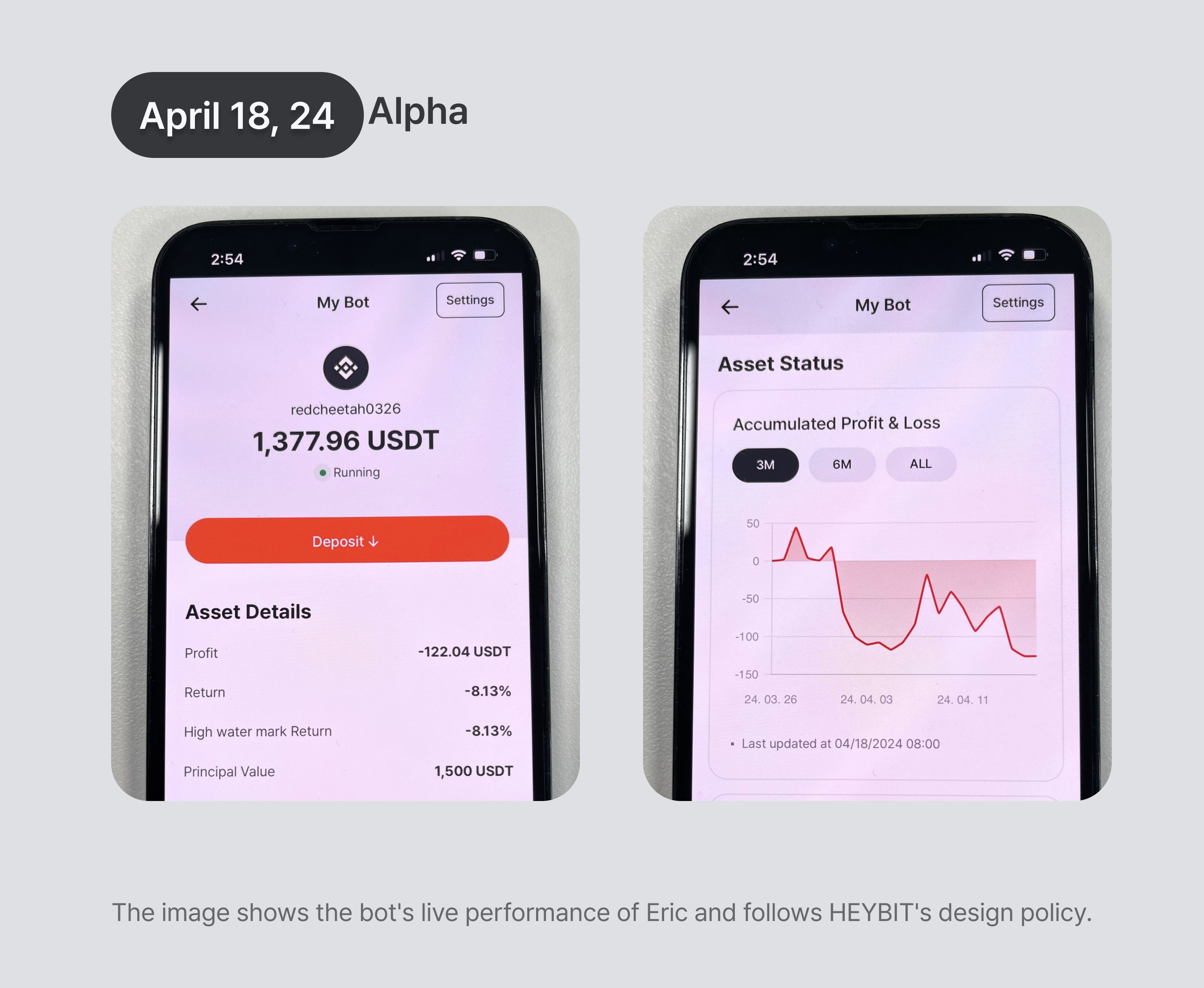

My Alpha

-

Compared to Last week,

- Alpha’s Return : -2.62% → -8.13% (-5.51%)

- Alpha’s PNL : -39.34 USDT → -122.04 USDT(-82.66 USDT)

- Fortunately, Alpha has avoided a major crash compared to Beta, demonstrating the effectiveness of my investment for hedging purposes; However, it is currently nearing a -10% loss. Given the significant market downturn, I now plan to increase Alpha’s leverage to 2x for taking a more aggressive stance. Additionally, I will lower my stop-loss threshold from -10% to -15%. I'm really hoping for a recovery.

So…

- Despite my misjudgments about the timing of the altcoin market and missing the optimal stop-loss moments, which have led to significant losses, I remain optimistic that the bull market has not yet ended.

- I plan to adjust my portfolio and respond to the market with renewed strategy alongside Heybit. It's a tough time for everyone, but let's all survive and thrive through this market correction!

Updated on April 18, 2024