Welcome to Eric's Investment Diary!

Here, I aim to share my diverse investment experiences, insights, and

the lessons learned along the way. From the joys of successful

investments to the challenges presented by market volatility, this diary

will serve as a chronicle of my journey through the crypto world.

I

look forward to investing alongside all of you, our HEYBIT customers,

until we all achieve our financial goals together!

Market Overview

- The U.S. March ISM Manufacturing Index recorded 50.3, marking the first time since September 2022 it has exceeded 50 points.

- The probability of the Federal Reserve cutting rates in June has fallen below 50%.

- Israel has conducted an airstrike on the Iranian consulate.

- These three significant events have led to an increase in U.S. 10-year Treasury yields, causing a decline in risk assets.

- Consequently, there was a net outflow of $88 million from the BTC spot ETF on April 1st, resulting in Bitcoin's price dropping to around $66k.

My Investment

-

On March 27th, I started managing $1,500 USDT each in Alpha Binance and

Beta HAI.

I chose HAI for its potentially higher returns in altcoins and included Alpha for portfolio risk management with its market-neutral strategy.

- For HAI, I'm planning to realize profits immediately if satisfactory due to no mid-term termination fees, no management fees due to a promotion, and looking for re-entry points afterward.

-

I'll consider terminating if there's a -10% loss or a profit between

+30% to +50%, then reassess the market situation before re-entering.

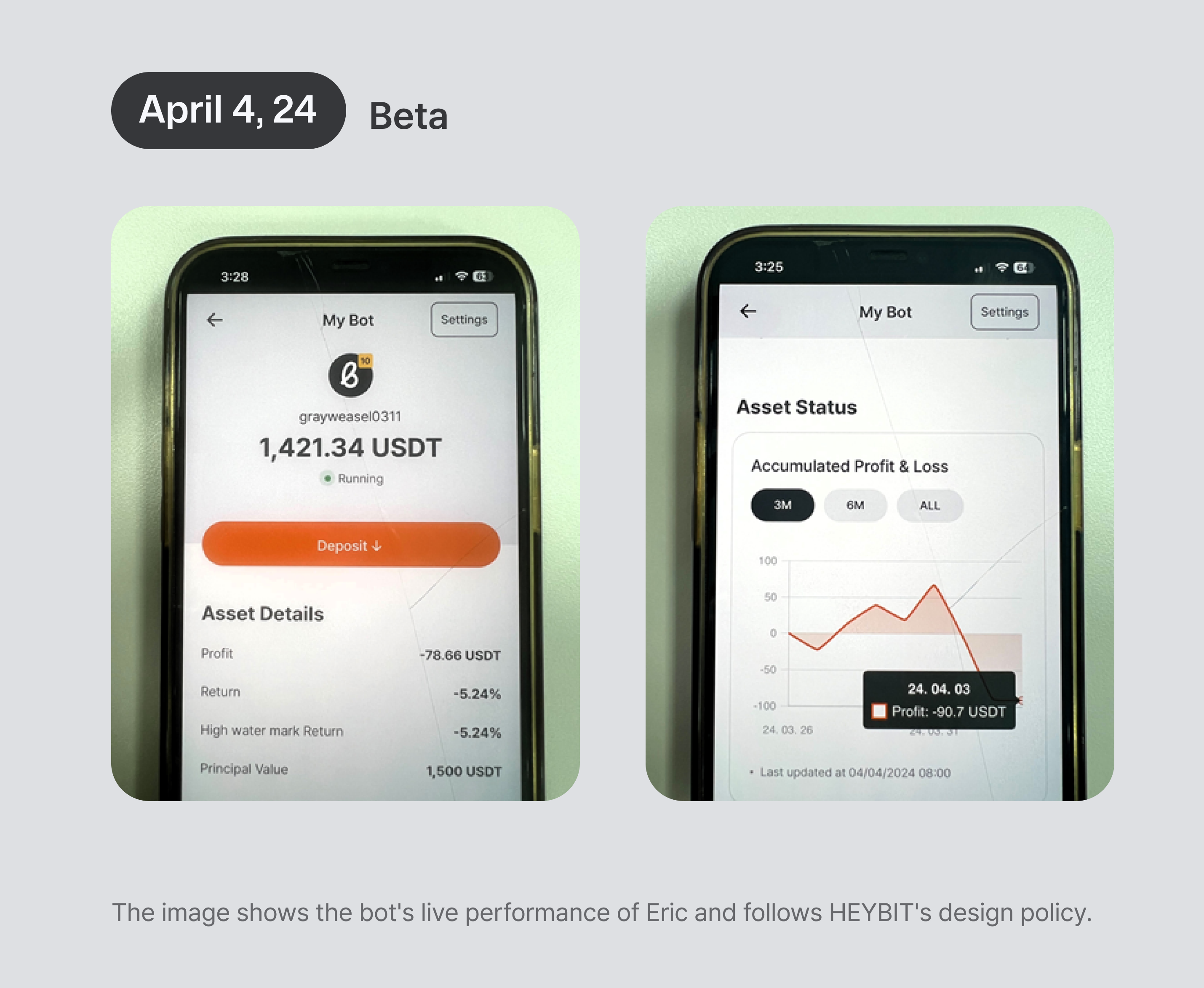

My Beta

-

As of April 1st, due to several negative factors, the portfolio has

fallen to -5%. It's still at a tolerable level, and I plan to withstand

up to a -10% loss. Despite feeling uneasy, I believe the altcoin market

hasn't even started yet, so I'm trying to stay positive!

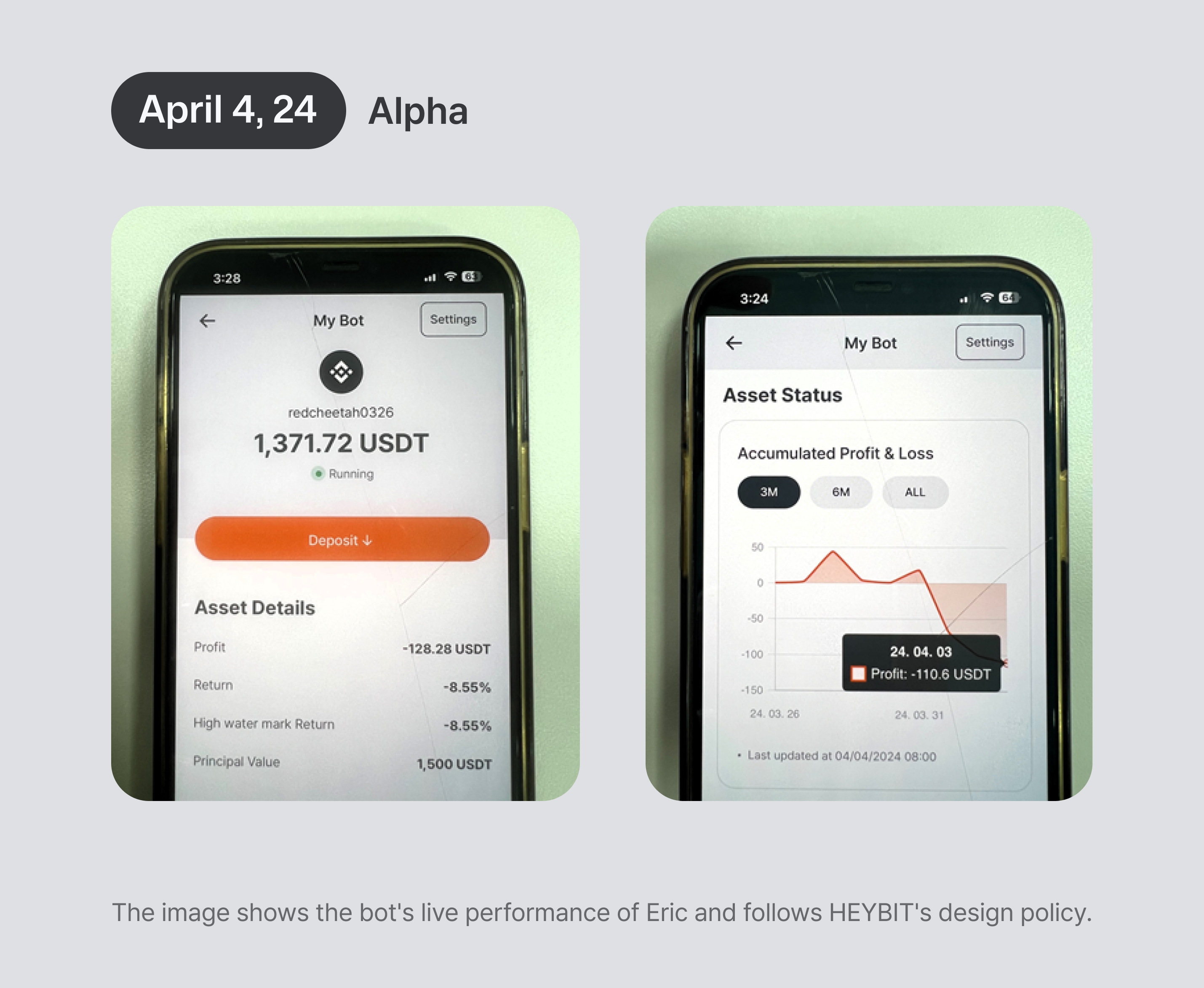

My Alpha

-

I aimed for a market-neutral approach to minimize portfolio risk, a

choice that now feels somewhat disappointing. Just like with the Beta

strategy, I'm planning to persevere through up to a -10% downturn with

Alpha as well.

So…

It seems like everything I buy just ends up falling...

I know

the investment should be viewed in longer term but can’t help

feeling down when the performance goes down every time. I am sure some of

the other users might be feeling similar.

Come on, Beta,

Alpha, rise up!!

To the moon please!

Updated in April 5, 2024