Bitcoin and Ethereum prices surge as the prospect of a US Ethereum

spot ETF gains momentum once more. Here’s an overview of the digital

market trends from the past two weeks.

Bitcoin for the past 2 weeks ending May 20th rose 12.96%, Ethereum 19.29% and the rest of the market 6.75%. Bitcoin and Ethereum dominance has risen throughout this period.

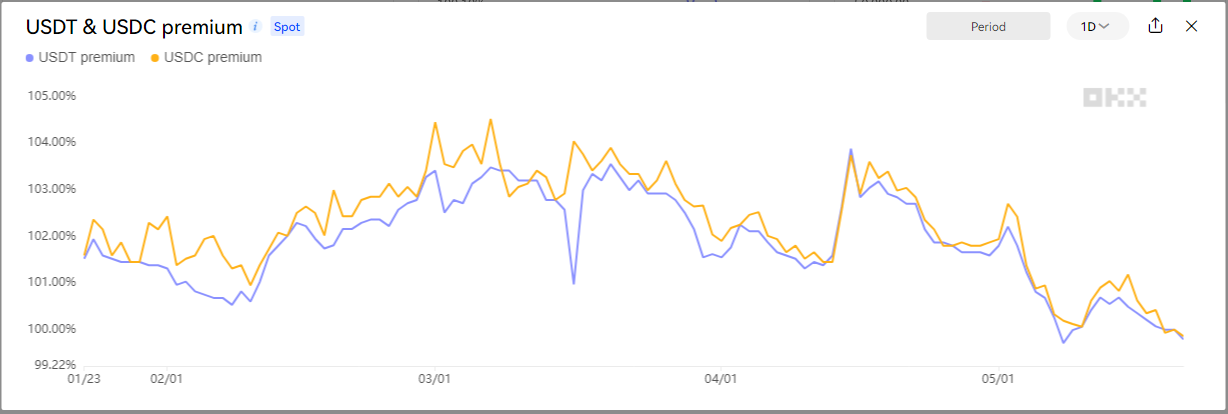

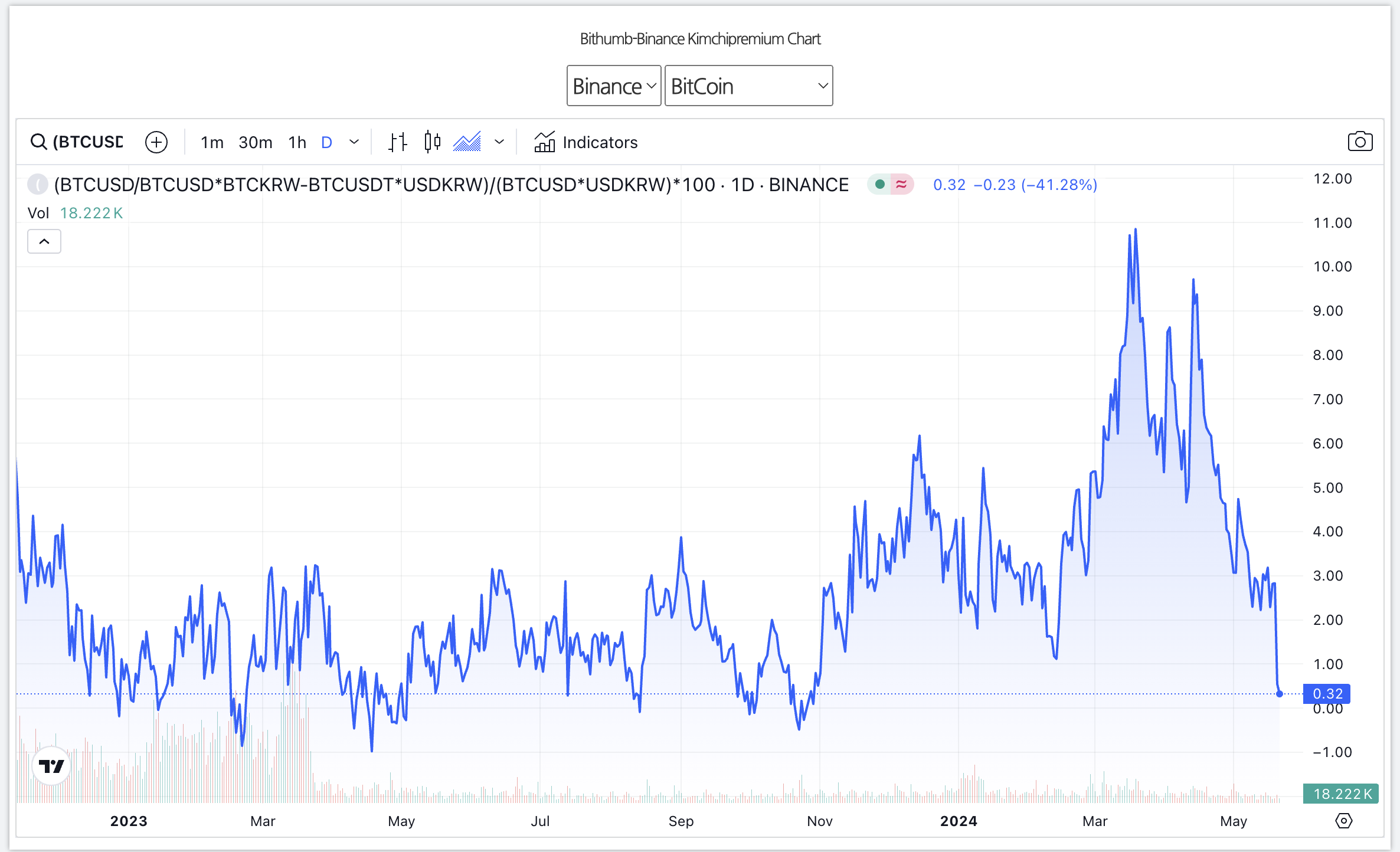

A favorable CPI report and moderately strong net inflows into the Bitcoin spot ETFs encouraged the digital asset market to rise in the past week gradually. But it wasn’t until yesterday when several US exchanges were asked to update 19b-4 filings on an accelerated basis, which suggests more imminent Ethereum spot ETF approval, that the market really took off. However, some indicators show that retail participation still remains weak (Figure 1,2), which could imply that even higher prices are on the horizon. For now, whether the Ethereum spot ETF actually goes through will be on top of the traders’ minds.

Figure 1,2: Despite the price surge, both the stablecoin premium and the Korean exchange premium remained subdued. / Source: OKX, Tradingview

As mentioned earlier, the CPI and retail sales reports in the US came in below expectations, causing both interest rates and the dollar to decline further. This prompted the Nasdaq index to reach all-time highs again. With such favorable macro tailwinds, it was inevitable that digital asset prices also followed higher. As long as inflation remains low, the "bad is good" sentiment is likely to persist in the near future.