Despite some macroeconomic tailwinds, digital asset prices have not

fully recovered. Here’s an overview of the digital market trends

from the past two weeks.

Bitcoin for the past 2 weeks ending May 6th fell -5.47%, Ethereum -1.99% and the rest of the market -3.42%. Bitcoin dominance fell slightly during the period.

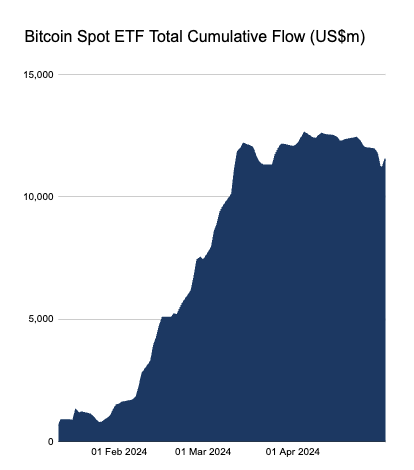

Following the largest outflow day on May 1st, with a net outflow exceeding $560M from Bitcoin spot ETFs, the situation has shown slight improvement with net inflows recorded in the first two days of this week. What is more, Grayscale has begun experiencing net inflows, suggesting that the recent exodus may have come to an end. Unsurprisingly, ever since the cumulative flows began to stagnate, the market has either been sideways or down (Figure 1). With the likelihood of an Ethereum ETF very low at this stage, the BTC spot ETF will continue to dominate price action.

The recent FOMC meeting took a decidedly dovish turn with the announcement of a reduction in quantitative tightening. Additionally, US data indicating an economic slowdown has increased the likelihood of two rate cuts this year. Consequently, the dollar and interest rates have declined, which could mark a bullish turning point for risk assets.