Bitcoin remains constrained within a trading range as macro factors start to exert pressure. Let us bring you the digital market overviews for the past two weeks.

Bitcoin for the past 2 weeks ending 8th April rose 2.49%, Ethereum 2.90% and the rest of the market 0.06%. As the market continued its consolidation, Bitcoin and Ethereum outperformed the rest of the alt-coins.

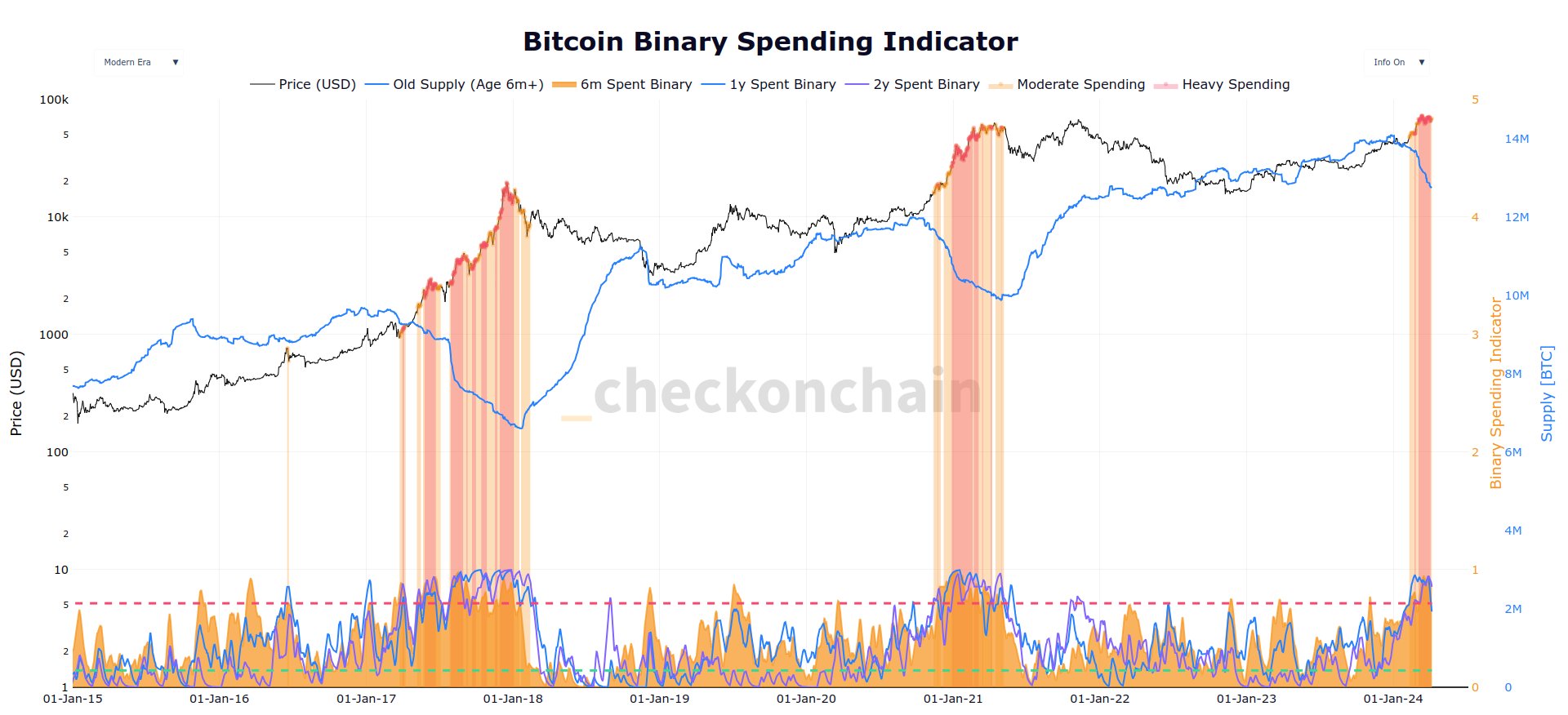

There are now mixed signals from the US Bitcoin spot ETFs. Despite witnessing net inflows for four out of five days last week, today marked a shift back to net outflows, casting a shadow over investor sentiment. Glassnode analysts have intriguingly noted that long-term holders are offloading their positions into fresh buying interest (Figure 1). As you can see this happened in both late 2017 and mid 2021 tops. While this does not signal the end of the bull market, it is a development that warrants attention. Ordinals stay hot as we approach the halving event, while in the meme coin world, a lot of activity has shifted from Solana to the Base chain.

We hinted in the last newsletter that macro indicators were coming in hotter than expected. This was precisely demonstrated by the ISM Manufacturing PMI last week, which pushed the interest rates and the dollar higher. Although risk assets have largely disregarded inflation and the uptrend in economic activity until now, they are beginning to feel the strain of these pressures. The US CPI numbers are set to be released tomorrow, meriting close attention in light of this discussion.